Question: I KNOW THE ANSWER BUT I NEED YOU TO EXPLAIN THESE QUESTIONS IN DETAIL? Question One Economic Status Most Likely Given the estimated returns three

I KNOW THE ANSWER BUT I NEED YOU TO EXPLAIN THESE QUESTIONS IN DETAIL?

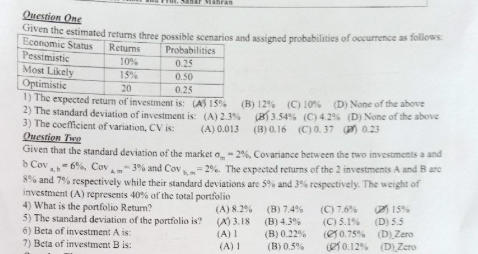

Question One Economic Status Most Likely Given the estimated returns three possible scenarios and assigned probabilities of occurrence as follows. Returns Probabilities Pessimistic 10 0.25 15% 0.50 Optimistic 20 0.25 1) The expected return of investment is: (AS 15% (B) 12% (C) 10% (D) None of the above 2) The standard deviation of investment is (A) 2.3% / 3.54% (C) 4.2% (D) None of the above 3) The coefficient of variation, CV is (A) 0.013 (13) 0.16 (C) 0.37 0.23 Question Twee Given that the standard deviation of the market. -2%. Covariance between the two investments a and b Cov. - 6%, Covam-3% and Cov-2%. The expected returns of the 2 investments A and B are % ...A 8% and 7% respectively while their standard deviations are 5% and 3% respectively. The weight of investment (A) represents 40% of the total portfolio 4) What is the portfolio Return? (A) 8.2% (B) 7.4% (C) 7.6% 21 15% 5) The standard deviation of the portfolio is? (13.18 (A (B) 4.3% (C) 5.1% (D) 5.5 6) Beta of investment A is: (B) 0.229 (0.75% (D) Zero 7) Beta of investment B is. (A) 1 (B) 0.5% 10.12% (D) Zero (A) 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts