Question: I KNOW THE ANSWER BUT I NEED YOU TO EXPLAIN THESE QUESTIONS IN DETAIL? ( EXCEL SHEET) Question One Economic Status Most Likely Given the

I KNOW THE ANSWER BUT I NEED YOU TO EXPLAIN THESE QUESTIONS IN DETAIL? ( EXCEL SHEET)

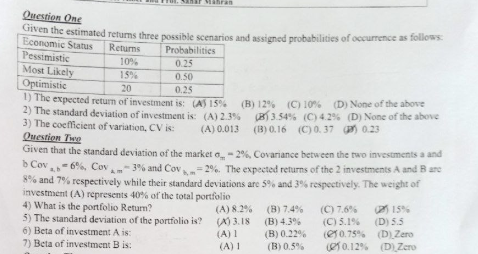

Question One Economic Status Most Likely Given the estimated returns three possible scenarios and assigned probabilities of occurrence as follows. Returns Probabilities Pessimistic 10 0.25 15% 0.50 Optimistic 20 0.25 1) The expected return of investment is: (AS 15% (B) 12% (C) 10% (D) None of the above 2) The standard deviation of investment is (A) 2.3% / 3.54% (C) 4.2% (D) None of the above 3) The coefficient of variation, CV is (A) 0.013 (13) 0.16 (C) 0.37 0.23 Question Twee Given that the standard deviation of the market. -2%. Covariance between the two investments a and b Cov. - 6%, Covam-3% and Cov-2%. The expected returns of the 2 investments A and B are % ...A 8% and 7% respectively while their standard deviations are 5% and 3% respectively. The weight of investment (A) represents 40% of the total portfolio 4) What is the portfolio Return? (A) 8.2% (B) 7.4% (C) 7.6% 21 15% 5) The standard deviation of the portfolio is? (13.18 (A (B) 4.3% (C) 5.1% (D) 5.5 6) Beta of investment A is: (B) 0.229 (0.75% (D) Zero 7) Beta of investment B is. (A) 1 (B) 0.5% 10.12% (D) Zero (A) 1 Question One Economic Status Most Likely Given the estimated returns three possible scenarios and assigned probabilities of occurrence as follows. Returns Probabilities Pessimistic 10 0.25 15% 0.50 Optimistic 20 0.25 1) The expected return of investment is: (AS 15% (B) 12% (C) 10% (D) None of the above 2) The standard deviation of investment is (A) 2.3% / 3.54% (C) 4.2% (D) None of the above 3) The coefficient of variation, CV is (A) 0.013 (13) 0.16 (C) 0.37 0.23 Question Twee Given that the standard deviation of the market. -2%. Covariance between the two investments a and b Cov. - 6%, Covam-3% and Cov-2%. The expected returns of the 2 investments A and B are % ...A 8% and 7% respectively while their standard deviations are 5% and 3% respectively. The weight of investment (A) represents 40% of the total portfolio 4) What is the portfolio Return? (A) 8.2% (B) 7.4% (C) 7.6% 21 15% 5) The standard deviation of the portfolio is? (13.18 (A (B) 4.3% (C) 5.1% (D) 5.5 6) Beta of investment A is: (B) 0.229 (0.75% (D) Zero 7) Beta of investment B is. (A) 1 (B) 0.5% 10.12% (D) Zero (A) 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts