Question: I know the answer here for this question is D, but can someone explain to me why? besides, what's the difference between yield to maturity

I know the answer here for this question is D, but can someone explain to me why? besides, what's the difference between yield to maturity and interest rate?

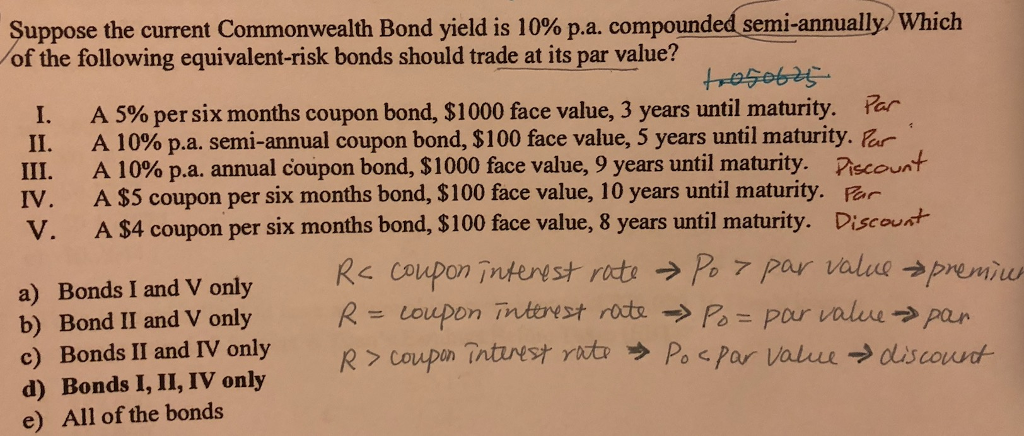

Suppose the current Commonwealth Bond yield is 10% pa. compounded semi-annually which of the following equivalent-risk bonds should trade at its par value? A 5% per six months coupon bond, $1000 face value, 3 years until maturity. 11. A 1 0% pa. semi-annual coupon bond, $100 face value, 5 years until maturity. 111. A 10% pa. annual coupon bond, $1000 face value, 9 years until maturity. Ascount IV. A $5 coupon per six months bond, $100 face value, 10 years until maturity. r V. A $4 coupon per six months bond, $100 face value, 8 years until maturity. Discoust a) Bonds I and V only c) Bonds ? and IV only d) Bonds I, II, IV only e) All of the bonds R >coupon intuestrato?P.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts