Question: I know the answer is C, but I dont know why. Please correct me. When the exchange lacks commercial substance... If a FV of asset

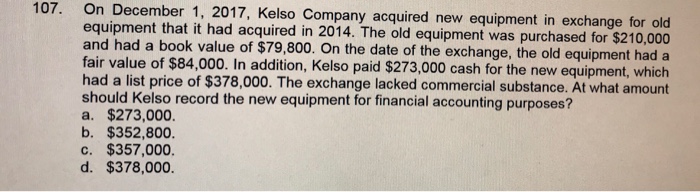

107. On December 1, 2017, Kelso Company acquired new equipment in exchange for old equipment that it had acquired in 2014. The old equipment was purchased for and had a book value of $79,800. On the date of the exchange, the old equipment had a fair value of $84,000. In addition, Kelso paid $273,000 cash for the new equipment, which had a list price of $378,000. The exchange lacked commercial substance. At what amount should Kelso record the new equipment for financial accounting purposes? a. $273,000. b. $352,800. c. $357,000. d. $378,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts