Question: I know the answer is C. Please, correct me when Im wrong. When the exchange lacks commercial substance... If a FV of asset exchanged is

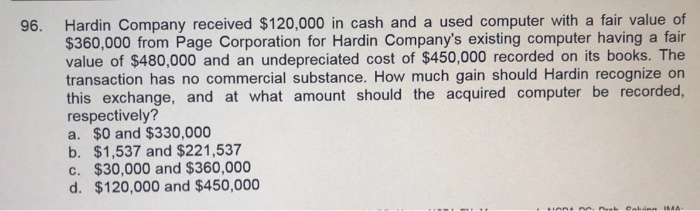

Hardin Company received $120,000 in cash and a used computer with a fair value of $360,000 from Page Corporation for Hardin Company's existing computer having a fair value of $480,000 and an undepreciated cost of $450,000 recorded on its books. The transaction has no commercial substance. How much gain should Hardin recognize on 96. this exchange, and at what amount should the acquired computer be recorded, respectively? a. $0 and $330,000 b. $1,537 and $221,537 c. $30,000 and $360,000 d. $120,000 and $450,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts