Question: I know the selected answer is correct, just want to see step by step how they come to that. Moving to the next question prevents

I know the selected answer is correct, just want to see step by step how they come to that.

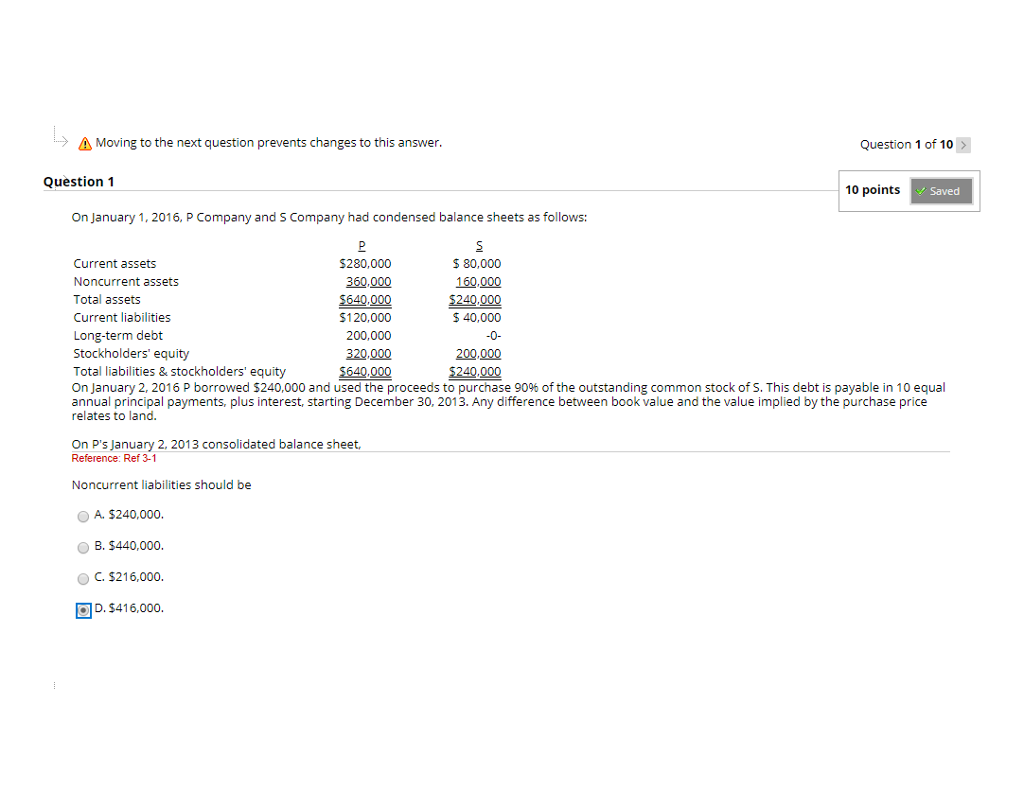

Moving to the next question prevents changes to this answer Question 1 of 10 Question 1 10 points Saved On January 1, 2016, P Company and S Company had condensed balance sheets as follows: Current assets Noncurrent assets Total assets Current liabilities S280,000 360,000 $640,000 $120,000 200,000 320,000 $640,000 $ 80,000 160,000 $240,000 $ 40,000 Long-term debt Stockholders equity Total liabilities & stockholders' equity On January 2, 2016 p borrowed $240,000 and used the proceeds to purchase 90% of the outstanding common stock of S. This debt is payable in 10 equal annual principal payments, plus interest, starting December 30, 2013. Any difference between book value and the value implied by the purchase price relates to land. 200,000 $240,000 On P's January 2, 2013 consolidated balance sheet, Reference: Ref 3-1 Noncurrent liabilities should be A. $240,000. O B. $440,000. O C.$216,000 D.$416,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts