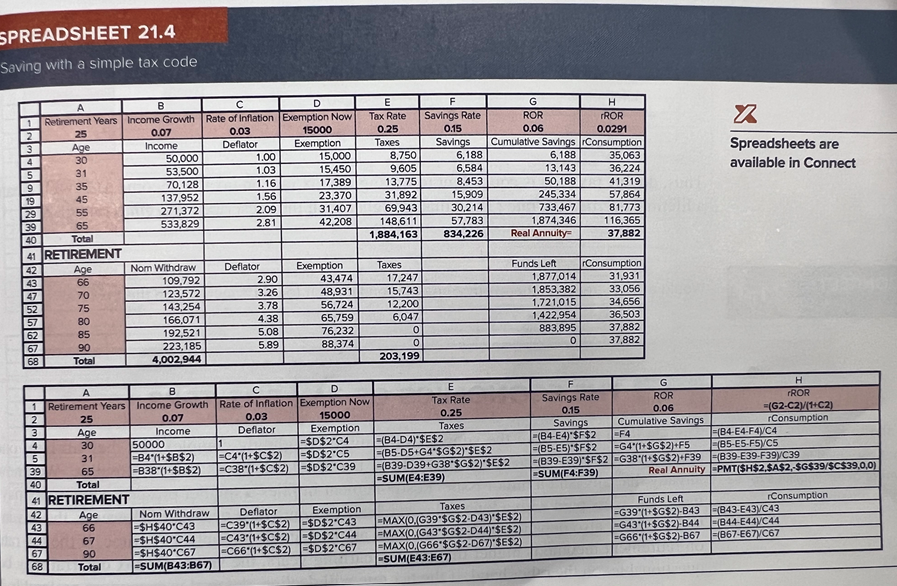

Question: I know there is a lot here, so I will try my best to be specific. The following Spreadsheet 21.4 shows a retirement plan with

I know there is a lot here, so I will try my best to be specific. The following Spreadsheet 21.4 shows a retirement plan with formulas on how the work was calculated. Please see below:

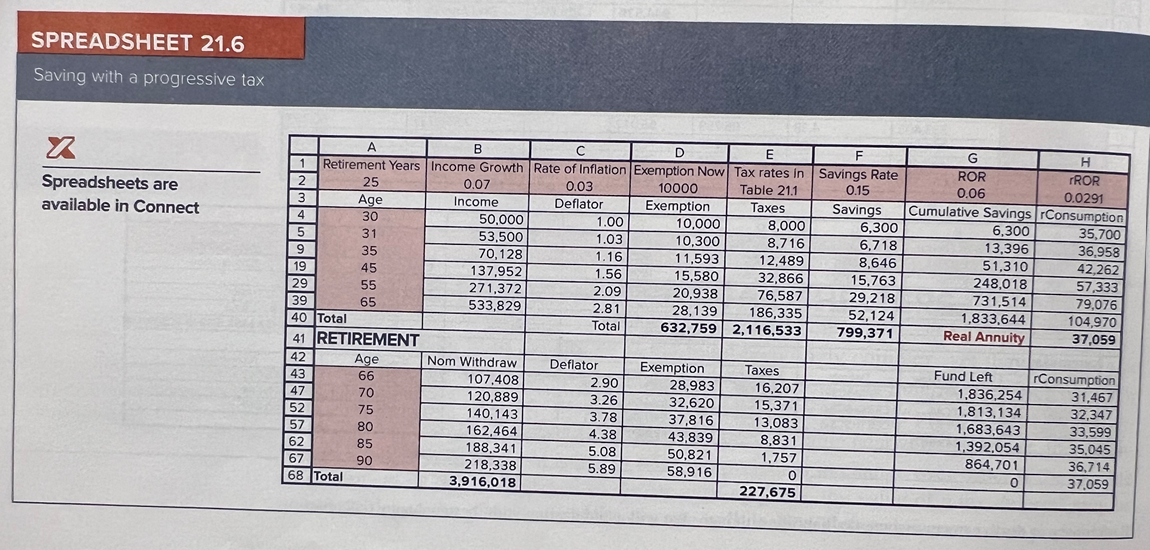

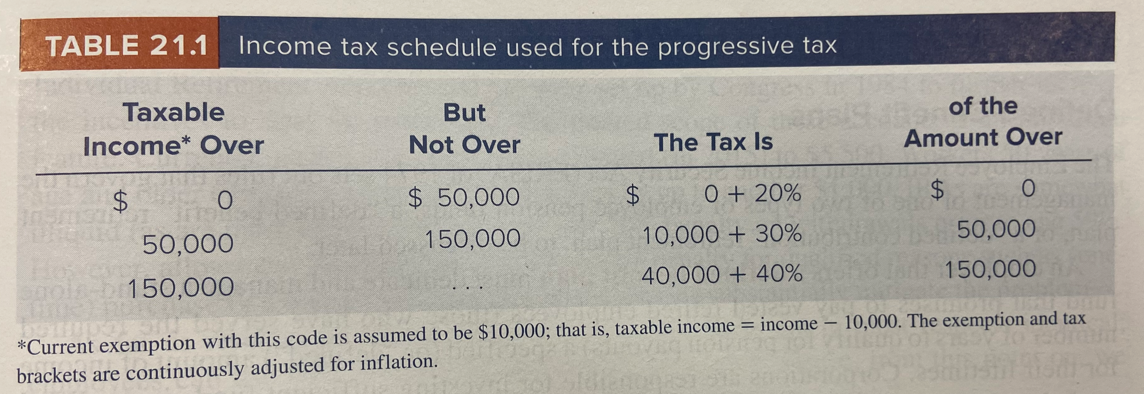

Now, Spreadsheet 21.6 is a replica of Spreadsheet 21.4, but there are two differences. The Exemption Now in Column D has been changed from 15,000 to 10,000, and the Tax Rates in Column E have been changed from a flat rate of 0.25 to a progressive rate shown in Table 21.1. The new tax rate is 20% for the first $50,000, 30% for the next $100,000, and 40% for any amount over 150%000 .Please reference below:

Could you please show the math/calculations and/or formulas on how the new Tax Rates in Spreadsheet 21.6 were formulated? No matter what I've tried, I am a few dollars off of the numbers that show in Column E for Spreadsheet 21.6.

Thank you for your help and time!

SPREADSHEET 21.4 Saving with a simple tax code SPREADSHEET 21.6 Saving with a progressive tax *Current exemption with this code is assumed to be $10,000; that is, taxable income = income 10,000. The exemption and tax brackets are continuously adjusted for inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts