Question: I know this is alot. There are 14 problems. Im not confident in my capability to do these on a test. Could you please work

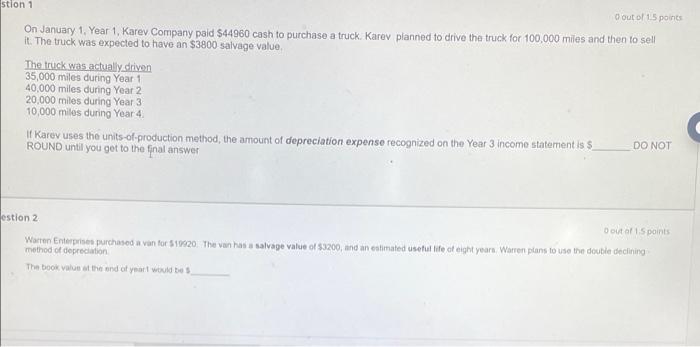

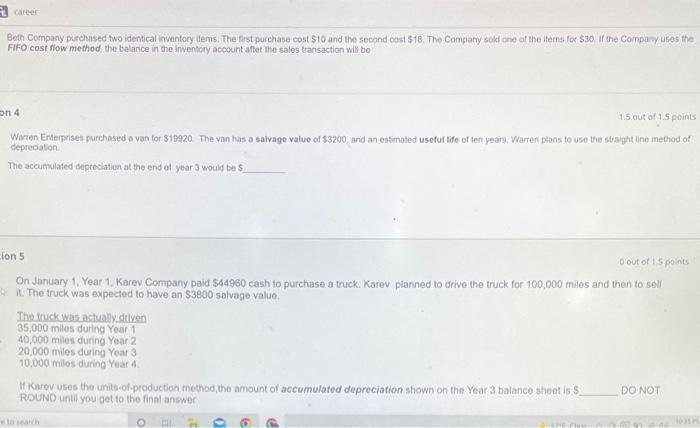

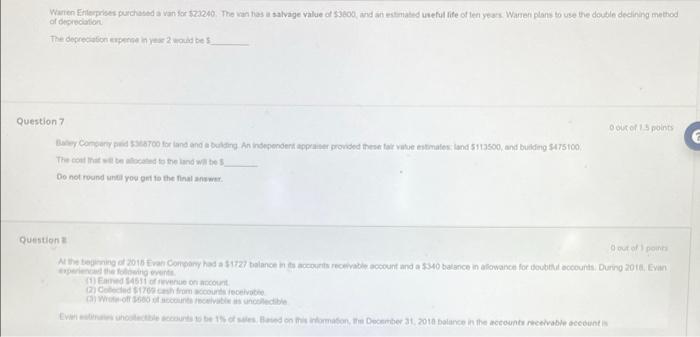

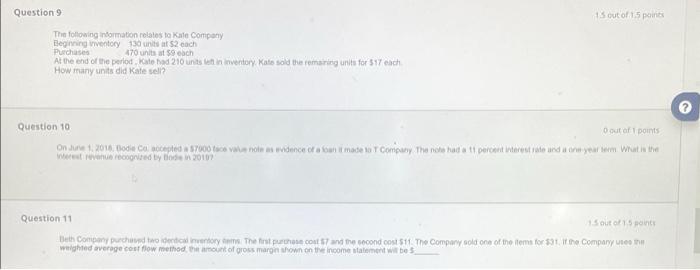

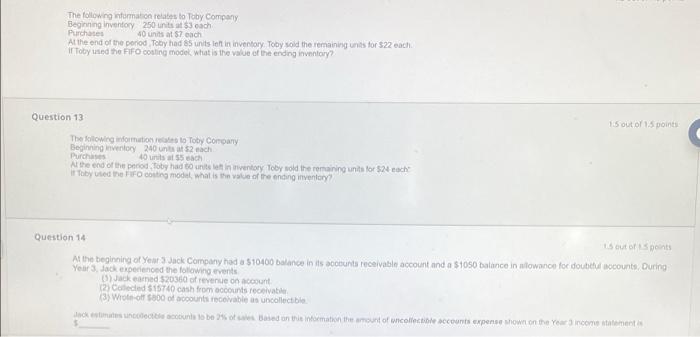

stion 1 0 out of 1.5 points On January 1, Year 1, Karev Company paid $44960 cash to purchase a truck. Karev planned to drive the truck for 100,000 miles and then to sell it. The truck was expected to have an $3800 salvage value. The truck was actually driven 35,000 miles during Year 11 40,000 miles during Year 2 20,000 miles during Year 31 10,000 miles during Year 4. If Karev uses the units-of-production method, the amount of depreciation expense recognized on the Year 3 income statement is $ ROUND until you get to the final answer DO NOT estion 2 0 t of 1.5 points Warren Enterprises purchased a van for $19920. The van has a salvage value of $3200, and an estimated useful life of eight years. Warren plans to use the double declining method of depreciation The book value at the end of yeart would be s career Beth Company purchased two identical inventory items. The first purchase cost $10 and the second cost $18. The Company sold one of the items for $30. If the Company uses the FIFO cost flow method, the balance in the inventory account after the sales transaction will be 1.5 out of 1.5 points Warren Enterprises purchased a van for $19920. The van has a salvage value of $3200, and an estimated useful life of ten years. Warren plans to use the straight line method of depreciation. on 4 The accumulated depreciation at the end of year 3 would be $ 0 out of 1,5 points On January 1, Year 1, Karev Company paid $44960 cash to purchase a truck. Karev planned to drive the truck for 100,000 miles and then to sell it. The truck was expected to have an $3800 salvage value. ion 5 The truck was actually driven 35,000 miles during Year 1 40,000 miles during Year 2 20,000 miles during Year 3 10,000 miles during Year 4. If Karev uses the units-of-production method, the amount of accumulated depreciation shown on the Year 3 balance sheet is $ ROUND until you get to the final answer to search O AL 10 are flow DO NOT 100 10 Waren Enterprises purchased a van for $23240. The van hias a salvage value of $3800, and an estimated useful life of ten years. Warren plans to use the double declining method of depreciation The depreciation expense in year 2 would be Question 7 Baley Company paid $368700 for land and a building. An independent appraiser provided these fair value estimates land $113500, and building $475100 The cost that will be allocated to the land will be S Do not round until you get to the final answer. Question 0 out of 1 points At the beginning of 2015 Evan Company had a $1727 balance in its accounts receivable account and a $340 balance in allowance for doubtful accounts. During 2018, Evan experienced the following events o out of 1.5 points (1) Eamed $4511 of revenue on account (2) Colected $1769 cash from accounts receivable (3) We off $600 of accounts receivable as uncollectible Even es unoolectible accounts to be 1% of sales. Based on this information, the December 31, 2018 balance in the accounts receivable account is Question 9 The following information relates to Kate Company Beginning inventory 130 units at $2 each Purchases 470 units at $9 each At the end of the period, Kate had 210 units lett in inventory Kate sold the remaining units for $17 each How many units did Kate sell? 15 out of 1.5 points Question 10 0 out of 1 points On June 1, 2018, Blodie Co accepted a $7000 face value note as evidence of a loan it made to T Company The note had a 11 percent interest rate and a one-year term. What is the interest revenue recognized by biode in 20107 Question 11 1.5 out of 1.5 points Beth Company purchased two identical inventory tems. The first purchase cost $7 and the second cost $11. The Company sold one of the items for $31. If the Company uses the weighted average cost flow method, the amount of gross margin shown on the income statement will be 5 The following information relates to Toby Company 250 units at $3 each Beginning inventory Purchases 40 units at $7 each At the end of the period, Toby had 85 units left in inventory Toby sold the remaining units for $22 each If Toby used the FIFO costing model, what is the value of the ending inventory? Question 13 The following information relates to Toby Company Beginning inventory 240 units at $2 each Purchases 40 units at $5 each At the end of the period, Toby had 60 units left in inventory Toby sold the remaining units for $24 each It Toby used the FIFO costing model, what is the value of the ending inventory? 1.5 out of 1.5 points Question 14- 15 out of 15 points At the beginning of Year 3 Jack Company had a $10400 balance in its accounts receivable account and a $1050 balance in allowance for doubtful accounts, During Year 3, Jack experienced the following events (3) Jack eamed $20360 of revenue on account (2) Collected $15740 cash from accounts receivable (3) Wrote-off $800 of accounts receivable as uncollectible Jack estimates uncolectible accounts to be 2% of sales Based on this information the amount of uncollectible accounts expense shown on the Year 3 income statement is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts