Question: i konw u guys one time just can answer one question. but please just this time help me, i have 20 questions need to upload

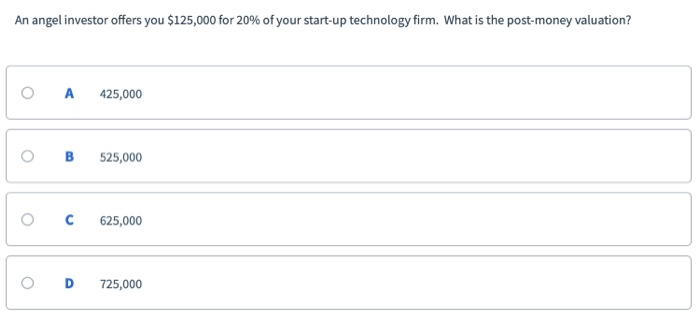

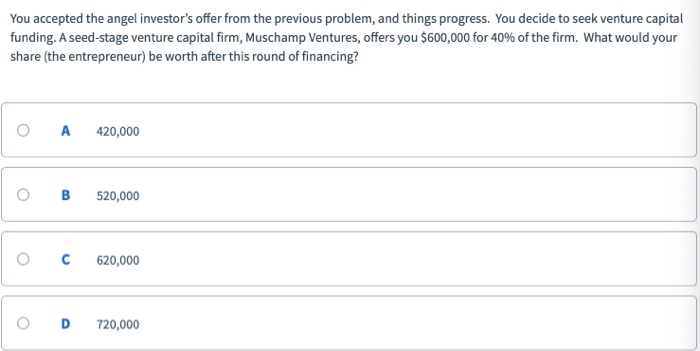

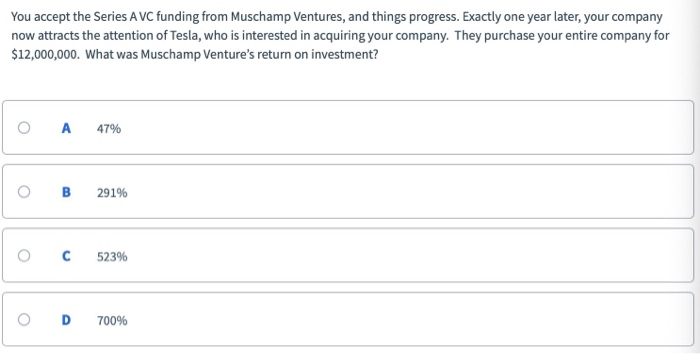

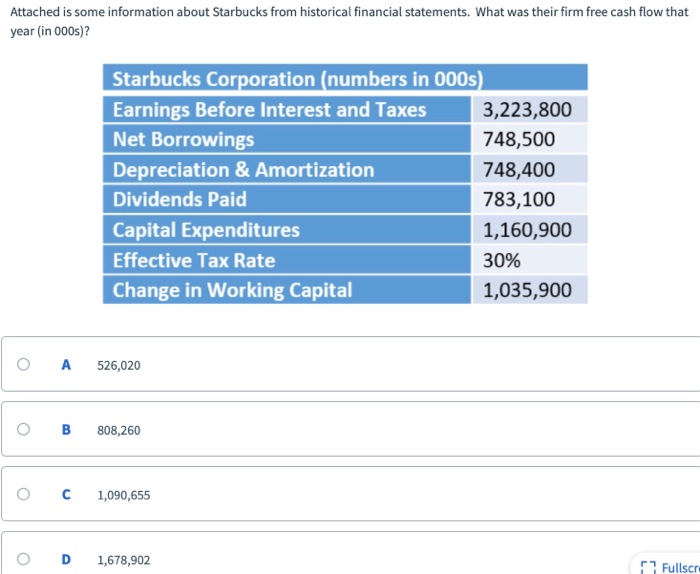

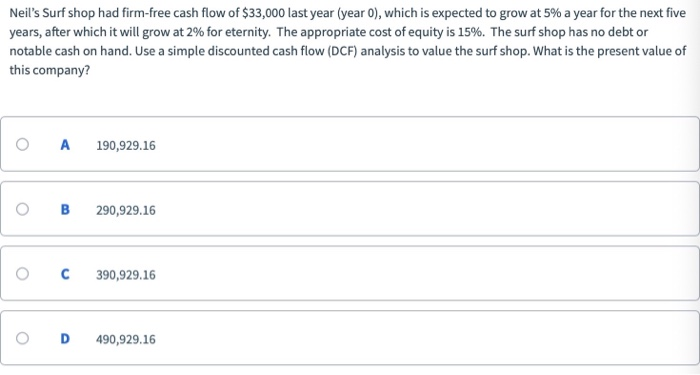

An angel investor offers you $125,000 for 20% of your start-up technology firm, what is the post-money valuation? 0 A 425,000 B 525,000 O C625,000 D 725,000 You accepted the angel investor's offer from the previous problem, and things progress. You decide to seek venture capital funding. A seed-stage venture capital firm, Muschamp Ventures, offers you $600,000 for 40% of the firm. what would your share (the entrepreneur) be worth after this round of financing? 0 A 420,000 B 520,000 620,000 O D 720,000 You accept the Series A VC funding from Muschamp Ventures, and things progress. Exactly one year later, your company now attracts the attention of Tesla, who is interested in acquiring your company. They purchase your entire company for $12,000,000. What was Muschamp Venture's return on investment? A 47% B 291% 52396 O D 70096 Attached is some information about Starbucks from historical financial statements. What was their firm free cash flow that year (in 000s)? Starbucks Corporation (numbers in 000s Earnings Before Interest and Taxes Net Borrowings Depreciation & Amortization Dividends Paid Capital Expenditures Effective Tax Rate Change in Working Capital 3,223,800 748,500 748,400 783,100 1,160,900 30% 1,035,900 0 A 526,020 B 808,260 1,090,655 O D 1,678,902 7 Fullscr Neil's Surf shop had firm-free cash flow of $33,000 last year (year 0), which is expected to grow at 5% a year for the next five years, after which it will grow at 2% for eternity. The appropriate cost of equity is 15%. The surf shop has no debt or notable cash on hand. Use a simple discounted cash flow (DCF) analysis to value the surf shop. What is the present value of this company? O A 190,929.16 B 290,929.16 C 390,929.16 D 490,929.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts