Question: i meed help woth this question UCHU https% L 52Flearn.liberty.ed6252Fwebapps%252Fportal.252Fframeset.sp.25371 Ano Seved a. A new operating system for an existing machine is expected to cost

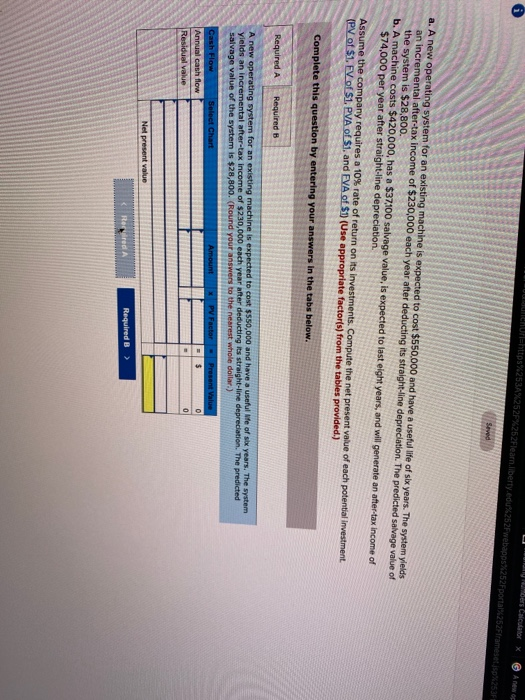

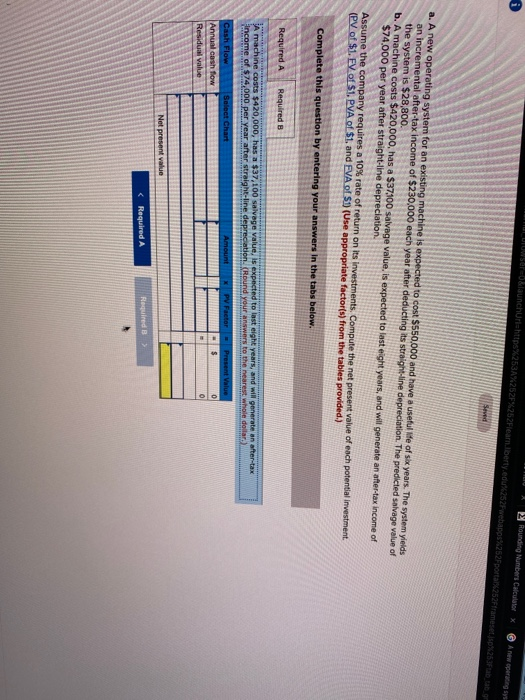

UCHU https% L 52Flearn.liberty.ed6252Fwebapps%252Fportal.252Fframeset.sp.25371 Ano Seved a. A new operating system for an existing machine is expected to cost $550,000 and have a useful life of six years. The system yields an incremental after-tax income of $230,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $28,800. b. A machine costs $420,000, has a $37,100 salvage value, is expected to last eight years, and will generate an after-tax income of $74,000 per year after straight-line depreciation Assume the company requires a 10% rate of return on its investments. Compute the net present value of each potential investment (PV of $1. FV of $1. PVA of $1. and FVA of S1) (Use appropriate factor(s) from the tables provided.) Complete this question by entering your answers in the tabs below. Required A Required B A new operating system for an existing machine is expected to cost $550,000 and have a useful le of six years. The system yields an incremental after-tax income of $230,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $28,800. (Round your answers to the nearest whole dollar.) Select Chart Amount PV Factor - Present Value Cash Flow Annual cash flow Residual value $ 0 Net present value Rere Required B > Uwero&launchuriahttps%253A%252F%252Flearniberty.edu6252Fwebapps%252Fportal 252Fframeset SM253FDb. Rounding Numbers Calculator X new per Seved a. A new operating system for an existing machine is expected to cost $550,000 and have a useful life of six years. The system yields an incremental after-tax income of $230,000 each year after deducting its straight line depreciation. The predicted salvage value of the system is $28,800. b. A machine costs $420,000, has a $37100 Salvage value is expected to last eight years, and will generate an after-tax income of $74.000 per year after straight-line depreciation, Assume the company requires a 10% rate of return on its Investments Compute the net present value of each potential investment (PV of $1. EV of $1. PVA of $1. and EVA of $0) (Use appropriate factor(s) from the tables provided.) Complete this question by entering your answers in the tabs below. Required A Required B A machine costs $420,000, has a $37,100 salvage value, is expected to last eight years, and will generate an after-tax income of $74,000 per year after straight-line depreciation (Round your answers to the nearest whole dollar) Select Chart Amount Cash Flow Annual cash flow Residual value X PV Factor - Present Value $ 0 Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts