Question: I n 2 0 2 4 , Sarah has $ 1 3 0 , 0 0 0 o f adjusted gross income and made charitable

Sarah has $ adjusted gross income and made charitable contributions follows:

$ cash the Eastwood School Business,

painting market value $ basis $ Hawthorne Academy, which intends sell the art support scholarships,

$ market value stock Grace Community Church,

$ cash a private charity,

$ qualified appreciated stock a private charity,

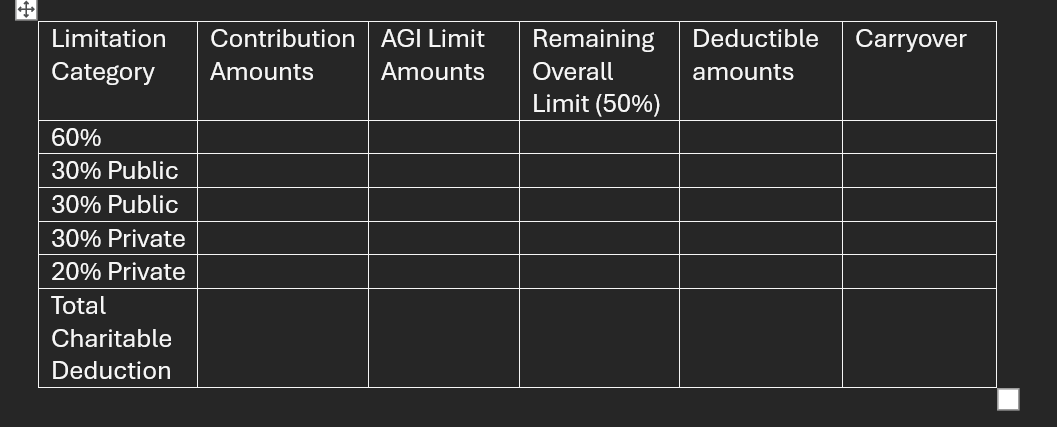

Calculate his charitable contributions using the following chart.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock