Question: I ned correct and quick answer, otherwise disliked be careful, in case correct upvote! My current wealth is $500 and I have exponential utility. There

I ned correct and quick answer, otherwise disliked be careful, in case correct upvote!

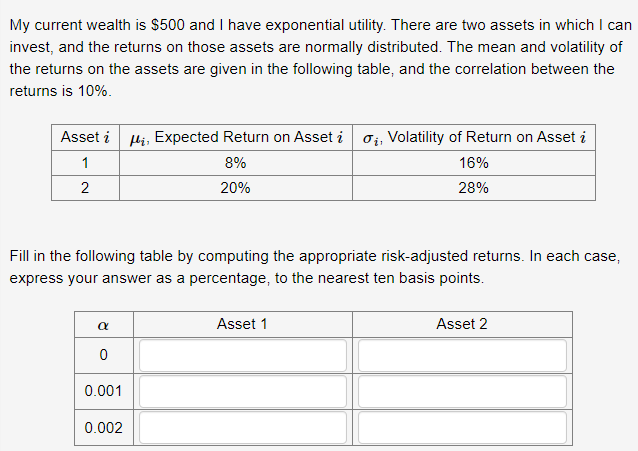

My current wealth is $500 and I have exponential utility. There are two assets in which I can invest, and the returns on those assets are normally distributed. The mean and volatility of the returns on the assets are given in the following table, and the correlation between the returns is 10% Asset i Mi, Expected Return on Asset i Oi, Volatility of Return on Asset i 1 8% 16% 2 20% 28% Fill in the following table by computing the appropriate risk-adjusted returns. In each case, express your answer as a percentage, to the nearest ten basis points. Asset 1 Asset 2 a 0 0.001 0.002 My current wealth is $500 and I have exponential utility. There are two assets in which I can invest, and the returns on those assets are normally distributed. The mean and volatility of the returns on the assets are given in the following table, and the correlation between the returns is 10% Asset i Mi, Expected Return on Asset i Oi, Volatility of Return on Asset i 1 8% 16% 2 20% 28% Fill in the following table by computing the appropriate risk-adjusted returns. In each case, express your answer as a percentage, to the nearest ten basis points. Asset 1 Asset 2 a 0 0.001 0.002

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts