Question: I need 1 and 5. Complete the below table to calculate the price of a $1.1 million bond issue under each of the following independent

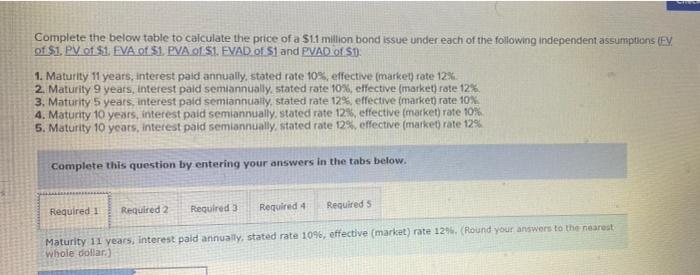

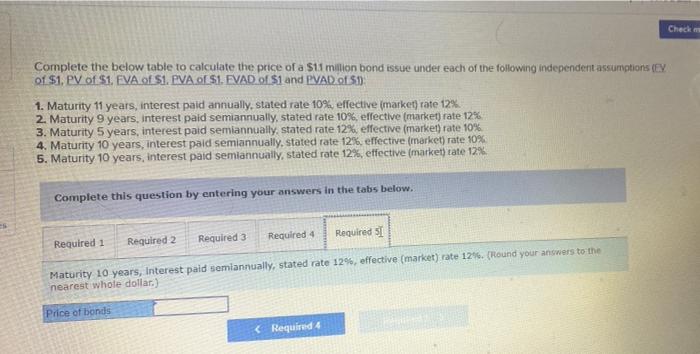

Complete the below table to calculate the price of a $1.1 million bond issue under each of the following independent assumptions (EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1. 1. Maturity 11 years, interest paid annually, stated rate 10%, effective (market) rate 12%. 2. Maturity 9 years, interest paid semiannually, stated rate 10%, effective (market) rate 12% 3. Maturity 5 years, interest paid semiannually, stated rate 12%, effective (market) rate 10% 4. Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 10% 5. Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 12% Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 41 Required 3 Required 5 Maturity 11 years, interest paid annually, stated rate 10%, effective (market) rate 12%. (Round your answers to the nearest whole dollar) Check m Complete the below table to calculate the price of a $1.1 million bond issue under each of the following independent assumptions (EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) 1. Maturity 11 years, interest paid annually, stated rate 10%, effective (market) rate 12%. 2. Maturity 9 years, interest paid semiannually, stated rate 10%, effective (market) rate 12% 3. Maturity 5 years, interest paid semiannually, stated rate 12%, effective (market) rate 10% 4. Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 10% 5. Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 12% Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 31 Required 4 Required 5 Maturity 10 years, Interest paid semiannually, stated rate 12%, effective (market) rate 12%. (Round your answers to the nearest whole dollar) Price of bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts