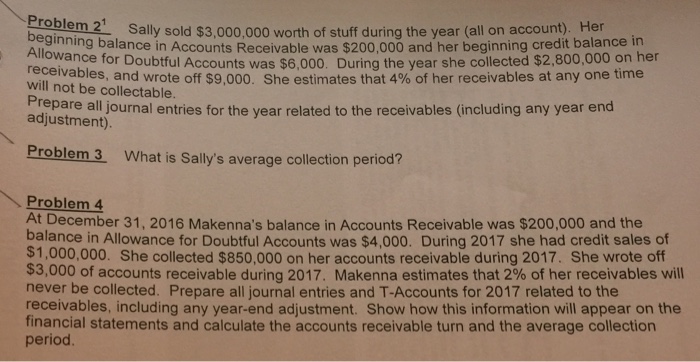

Question: I need (2,3,4) Problem 2 begi Sally sold $3,000,000 worth of stuff during the year (all on account). Her nning balance in Accounts Receivable was

Problem 2 begi Sally sold $3,000,000 worth of stuff during the year (all on account). Her nning balance in Accounts Receivable was $200,000 and her beginning credit balance in Allowance for Doubtful Accounts was s6.000. During the year she collected $2,800,000 on her receivables , and wrote off $9,000. She estimates that 4% of her receivables at any one time will not be collectable. repare all journal entries for the year related to the receivables (including any year end adjustment) Problem 3 Problem 4 What is Sally's average collection period? At December 31, 2016 Makenna's balance in Accounts Receivable was $200,000 and the balance in Allowance for Doubtful Accounts was $4,000. During 2017 she had credit sales of $1,000,000. She collected $850,000 on her accounts receivable during 2017. She wrote off $3,000 of accounts receivable during 2017, Makenna estimates that 2% of her receivables will never be collected. Prepare all journal entries and T-Accounts for 2017 related to the receivables, including any year-end adjustment. Show how this information will appear on the tinancial statements and calculate the accounts receivable turn and the average collection period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts