Question: I need #5 solved AFTER CLASS PRACTICE 10-1 The CEO of Americycle is evaluating the performance of two investment center divisions. Data for the two

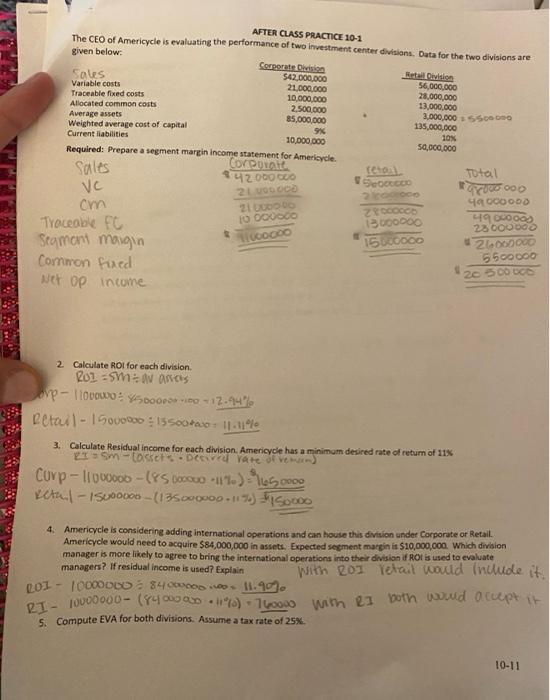

AFTER CLASS PRACTICE 10-1 The CEO of Americycle is evaluating the performance of two investment center divisions. Data for the two divisions are given below: Corporate Division $42,000,000 Retail Division Sales Variable costs 56,000,000 21,000,000 28,000,000 10,000,000 Traceable fixed costs Allocated common costs 13,000,000 2,500,000 Average assets 85,000,000 3,000,000 500.000 135,000,000 Weighted average cost of capital 9% 10% Current liabilities 10,000,000 50,000,000 Required: Prepare a segment margin income statement for Americycle Sales Corporate 842000000 21 000 000 VC cm 21000000 10 000000 Traceable FC Segment margin 11000000 Common Fixed Net op income retail wococco 210001000 28000000 13000000 15000000 2. Calculate ROI for each division. R01 SMav anvers vp-11000wo: 5000-100-12.94% Retail-15000000 15500+000= 11.11% 3. Calculate Residual income for each division. Americycle has a minimum desired rate of return of 11% 2I=Sm-Cassets Desired rate of remoen). Curp-11000000-(85000000 -11%) = 1650000 Keta|-15000000-(135000000+11%) = 150000 4. Americycle is considering adding international operations and can house this division under Corporate or Retail. Americycle would need to acquire $84,000,000 in assets. Expected segment margin is $10,000,000. Which division manager is more likely to agree to bring the international operations into their division if ROI is used to evaluate managers? If residual income is used? Explain 201 - 10000000 84.000000 100 11.9090 with 201 retail would include it. 10000000-(840000001140) 760000 with RI both would accept it T RI- 5. Compute EVA for both divisions. Assume a tax rate of 25%. 10-11 Total 8000000 49000000 49000000 23000000 #26000000 5500000 20 500 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts