Question: I need a handwritten calculation not using a software 4. $1000 is deposited uniformly and continuously each year for 5 years. Interest is 10% nominal

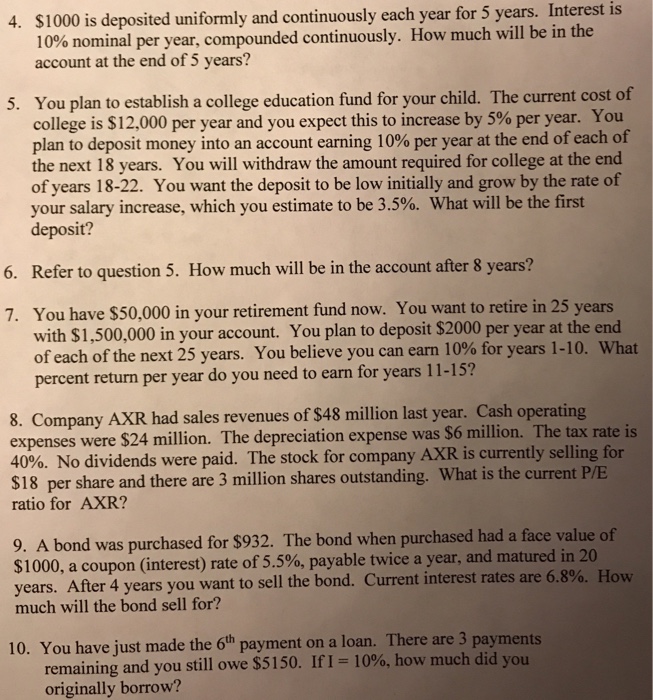

4. $1000 is deposited uniformly and continuously each year for 5 years. Interest is 10% nominal per year, compounded continuously. How much will be in the account at the end of 5 years? 5. You plan to establish a college education fund for your child. The current cost of college is $12,000 per year and you expect this to increase by 5% per year. You plan to deposit money into an account earning 10% per year at the end of each of the next 18 years. You will withdraw the amount required for college at the end of years 18-22. You want the deposit to be low initially and grow by the rate of your salary increase, which you estimate to be 3.5%. What will be the first deposit? 6. Refer to question 5. How much will be in the account after 8 years? You have $50,000 in your retirement fund now. You want to retire in 25 years with $1,500,000 in your account. You plan to deposit $2000 per year at the end of each ofthe next 25 years. You believe you can earn 10% for years 1-10. What percent return per year do you need to earn for years 11-15? 7. 8. Company AXR had sales revenues of $48 million last year. Cash operating expenses were $24 million. The depreciation expense was $6 million. The tax rate is 40%. No dividends were paid. The stock for company AXR is currently selling for $18 per sha ratio for AXR? re and there are 3 million shares outstanding. What is the current P/E 9. A bond was purchased for $932. The bond when purchased had a face value of $100, a coupon (interest) rate of 5.5%, payable twice a year, and matured in 20 years. Ater 4 years you want to sell the bond. Current interest rates are 6 much will the bond sell for? 10. You have just made the 6th payment on a loan. There are 3 payments remaining and you still owe $5150. If I = 10%, how much did you originally borrow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts