Question: i need a solution in excel format Husky corporation is a MNC operating with 70% exposure to British Pound (GBP) and 30% exposure to Euro

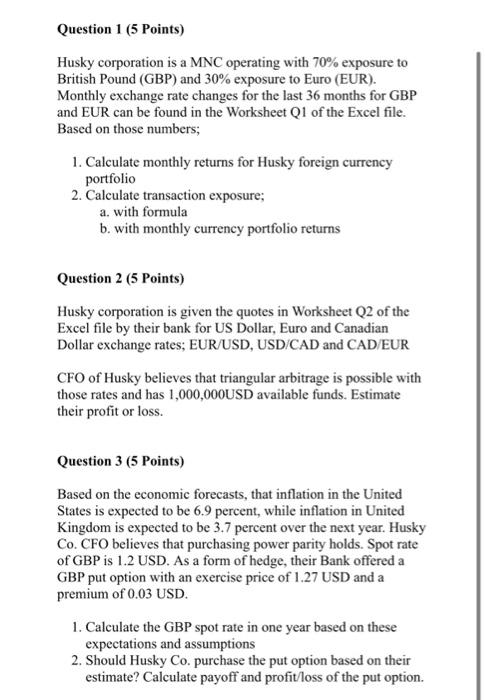

Husky corporation is a MNC operating with 70% exposure to British Pound (GBP) and 30% exposure to Euro (EUR). Monthly exchange rate changes for the last 36 months for GBP and EUR can be found in the Worksheet Q1 of the Excel file. Based on those numbers; 1. Calculate monthly returns for Husky foreign currency portfolio 2. Calculate transaction exposure; a. with formula b. with monthly currency portfolio returns Question 2 (5 Points) Husky corporation is given the quotes in Worksheet Q2 of the Excel file by their bank for US Dollar, Euro and Canadian Dollar exchange rates; EUR/USD, USD/CAD and CAD/EUR CFO of Husky believes that triangular arbitrage is possible with those rates and has 1,000,000USD available funds. Estimate their profit or loss. Question 3 (5 Points) Based on the economic forecasts, that inflation in the United States is expected to be 6.9 percent, while inflation in United Kingdom is expected to be 3.7 percent over the next year. Husky Co. CFO believes that purchasing power parity holds. Spot rate of GBP is 1.2 USD. As a form of hedge, their Bank offered a GBP put option with an exercise price of 1.27 USD and a premium of 0.03 USD. 1. Calculate the GBP spot rate in one year based on these expectations and assumptions 2. Should Husky Co. purchase the put option based on their estimate? Calculate payoff and profit/loss of the put option. Husky corporation is a MNC operating with 70% exposure to British Pound (GBP) and 30% exposure to Euro (EUR). Monthly exchange rate changes for the last 36 months for GBP and EUR can be found in the Worksheet Q1 of the Excel file. Based on those numbers; 1. Calculate monthly returns for Husky foreign currency portfolio 2. Calculate transaction exposure; a. with formula b. with monthly currency portfolio returns Question 2 (5 Points) Husky corporation is given the quotes in Worksheet Q2 of the Excel file by their bank for US Dollar, Euro and Canadian Dollar exchange rates; EUR/USD, USD/CAD and CAD/EUR CFO of Husky believes that triangular arbitrage is possible with those rates and has 1,000,000USD available funds. Estimate their profit or loss. Question 3 (5 Points) Based on the economic forecasts, that inflation in the United States is expected to be 6.9 percent, while inflation in United Kingdom is expected to be 3.7 percent over the next year. Husky Co. CFO believes that purchasing power parity holds. Spot rate of GBP is 1.2 USD. As a form of hedge, their Bank offered a GBP put option with an exercise price of 1.27 USD and a premium of 0.03 USD. 1. Calculate the GBP spot rate in one year based on these expectations and assumptions 2. Should Husky Co. purchase the put option based on their estimate? Calculate payoff and profit/loss of the put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts