Question: I need a step by step explanation on how to fill this table out (quantity, variable cost, cost of capital) based off of the information

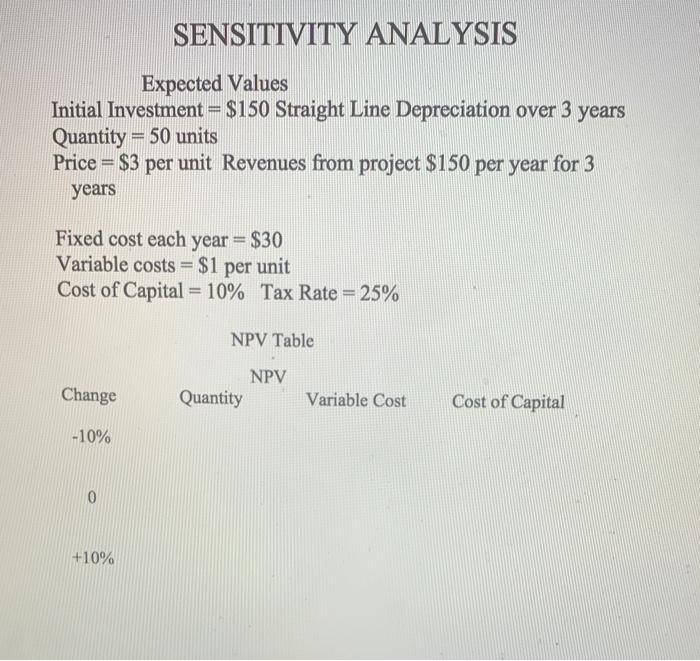

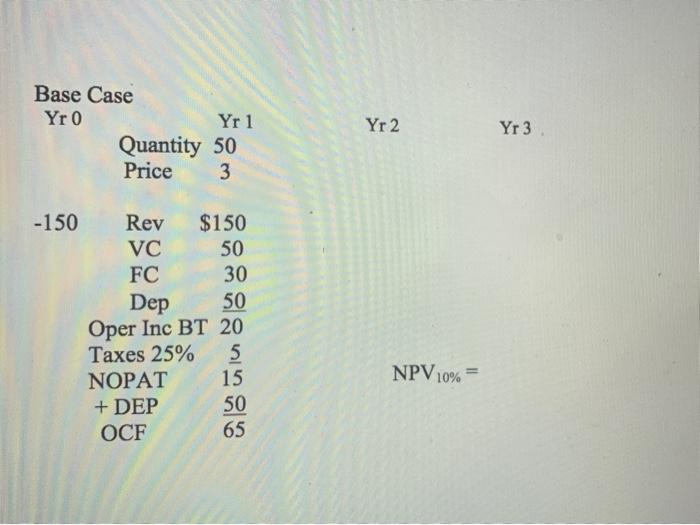

SENSITIVITY ANALYSIS Expected Values Initial Investment = $150 Straight Line Depreciation over 3 years Quantity = 50 units Price = $3 per unit Revenues from project $150 per year for 3 years Fixed cost each year = $30 Variable costs = $1 per unit Cost of Capital = 10% Tax Rate = 25% NPV Table Change NPV Quantity Variable Cost Cost of Capital -10% 0 +10% Base Case Yr 0 Yr 1 Quantity 50 Price 3 Yr 2 Yr 3 -150 Rev $150 VC 50 FC 30 Dep 50 Oper Inc BT 20 Taxes 25% 5 NOPAT 15 + DEP 50 OCF 65 NPV 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts