Question: I need an answer for part d only. Please do all the steps correctly and do not use any Excel or anything. Thanks. Suppose that

I need an answer for part d only. Please do all the steps correctly and do not use any Excel or anything. Thanks.

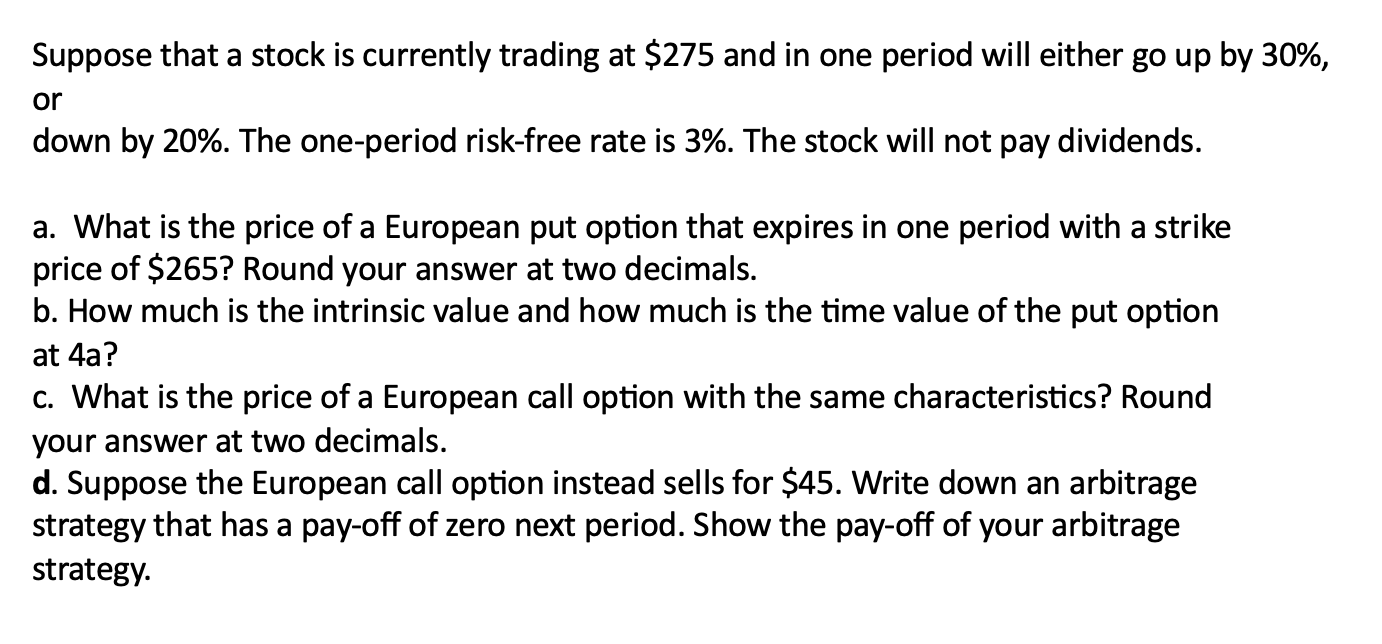

Suppose that a stock is currently trading at $275 and in one period will either go up by 30% or down by 20%. The one-period risk-free rate is 3%. The stock will not pay dividends. a. What is the price of a European put option that expires in one period with a strike price of $265 ? Round your answer at two decimals. b. How much is the intrinsic value and how much is the time value of the put option at 4a? c. What is the price of a European call option with the same characteristics? Round your answer at two decimals. d. Suppose the European call option instead sells for $45. Write down an arbitrage strategy that has a pay-off of zero next period. Show the pay-off of your arbitrage strategy. Suppose that a stock is currently trading at $275 and in one period will either go up by 30% or down by 20%. The one-period risk-free rate is 3%. The stock will not pay dividends. a. What is the price of a European put option that expires in one period with a strike price of $265 ? Round your answer at two decimals. b. How much is the intrinsic value and how much is the time value of the put option at 4a? c. What is the price of a European call option with the same characteristics? Round your answer at two decimals. d. Suppose the European call option instead sells for $45. Write down an arbitrage strategy that has a pay-off of zero next period. Show the pay-off of your arbitrage strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts