Question: OPTIONS investors will .. (drive up/drive down) ... the ..(maximum/minimum) price of the call... a. Circular File stock is selling for $29 a share. You

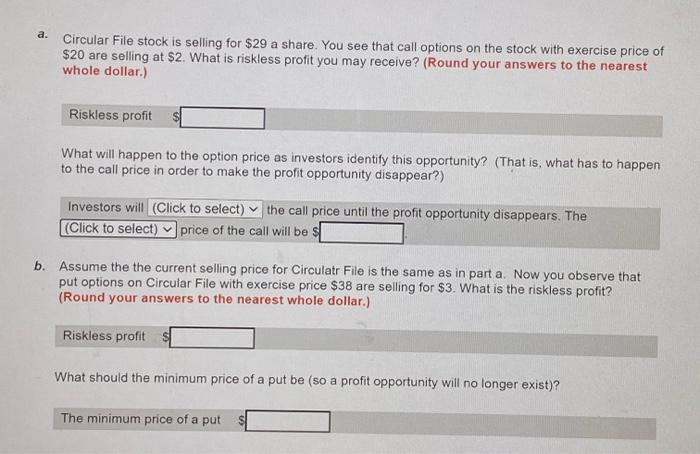

a. Circular File stock is selling for $29 a share. You see that call options on the stock with exercise price of $20 are selling at $2. What is riskless profit you may receive? (Round your answers to the nearest whole dollar.) Riskless profit What will happen to the option price as investors identify this opportunity? (That is what has to happen to the call price in order to make the profit opportunity disappear?) Investors will (Click to select) the call price until the profit opportunity disappears. The (Click to select) price of the call will be $ b. Assume the the current selling price for Circulatr File is the same as in part a. Now you observe that put options on Circular File with exercise price $38 are selling for $3. What is the riskless profit? (Round your answers to the nearest whole dollar.) Riskless profit What should the minimum price of a put be (so a profit opportunity will no longer exist)? The minimum price of a put S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts