Question: I NEED AN ANSWER QUICK! I WILL THUMBS UP/LIKE! Flextrola is developing a new electronics system product. Flextrola sells their product for $121 and leftover

I NEED AN ANSWER QUICK! I WILL THUMBS UP/LIKE!

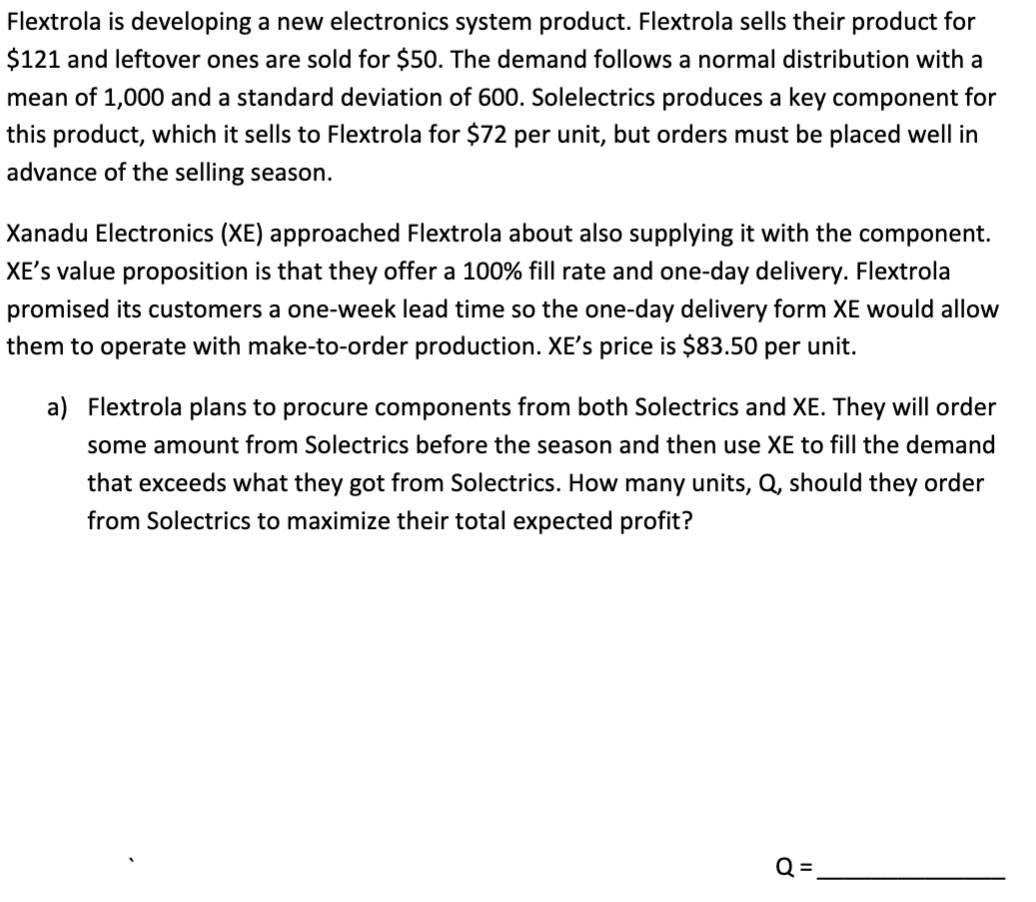

Flextrola is developing a new electronics system product. Flextrola sells their product for $121 and leftover ones are sold for $50. The demand follows a normal distribution with a mean of 1,000 and a standard deviation of 600. Solelectrics produces a key component for this product, which it sells to Flextrola for $72 per unit, but orders must be placed well in advance of the selling season. Xanadu Electronics (XE) approached Flextrola about also supplying it with the component. XE's value proposition is that they offer a 100% fill rate and one-day delivery. Flextrola promised its customers a one-week lead time so the one-day delivery form XE would allow them to operate with make-to-order production. XE's price is $83.50 per unit. a) Flextrola plans to procure components from both Solectrics and XE. They will order some amount from Solectrics before the season and then use XE to fill the demand that exceeds what they got from Solectrics. How many units, Q, should they order from Solectrics to maximize their total expected profit? Q = b) Under the scenario of part a), what is Flextrola's total expected profit? Expected Profit c) Suppose Flextrola ignores your answer to part a) and instead decides to order 800 components from Soletrics before the selling season. How many should Flextrola expect to order later from XE? Expected Order to XE = Flextrola is developing a new electronics system product. Flextrola sells their product for $121 and leftover ones are sold for $50. The demand follows a normal distribution with a mean of 1,000 and a standard deviation of 600. Solelectrics produces a key component for this product, which it sells to Flextrola for $72 per unit, but orders must be placed well in advance of the selling season. Xanadu Electronics (XE) approached Flextrola about also supplying it with the component. XE's value proposition is that they offer a 100% fill rate and one-day delivery. Flextrola promised its customers a one-week lead time so the one-day delivery form XE would allow them to operate with make-to-order production. XE's price is $83.50 per unit. a) Flextrola plans to procure components from both Solectrics and XE. They will order some amount from Solectrics before the season and then use XE to fill the demand that exceeds what they got from Solectrics. How many units, Q, should they order from Solectrics to maximize their total expected profit? Q = b) Under the scenario of part a), what is Flextrola's total expected profit? Expected Profit c) Suppose Flextrola ignores your answer to part a) and instead decides to order 800 components from Soletrics before the selling season. How many should Flextrola expect to order later from XE? Expected Order to XE =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts