Question: I need answer as soon as possible but complete answer Question # 03: Frazil Company purchased a machine on April 01, 2001 at a list

I need answer as soon as possible but complete answer

I need answer as soon as possible but complete answer

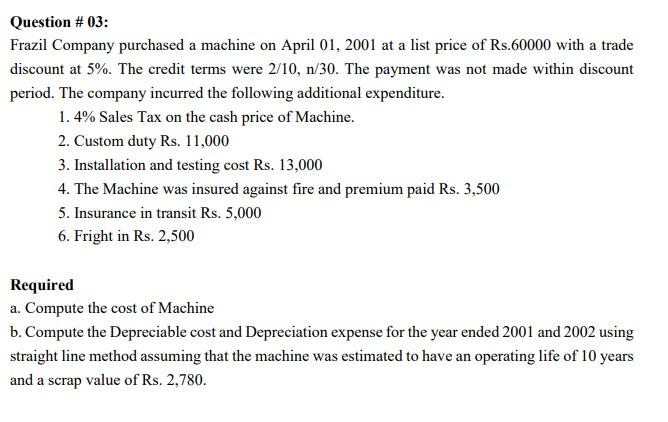

Question # 03: Frazil Company purchased a machine on April 01, 2001 at a list price of Rs.60000 with a trade discount at 5%. The credit terms were 2/10, n/30. The payment was not made within discount period. The company incurred the following additional expenditure. 1.4% Sales Tax on the cash price of Machine. 2. Custom duty Rs. 11,000 3. Installation and testing cost Rs. 13,000 4. The Machine was insured against fire and premium paid Rs. 3,500 5. Insurance in transit Rs. 5,000 6. Fright in Rs. 2,500 Required a. Compute the cost of Machine b. Compute the Depreciable cost and Depreciation expense for the year ended 2001 and 2002 using straight line method assuming that the machine was estimated to have an operating life of 10 years and a scrap value of Rs. 2,780

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts