Question: I need Answer by 1pm can anyone help me ? QUESTION 2 Given below are the summarised consolidated statement of financial position of Mighty Bod

I need Answer by 1pm can anyone help me ?

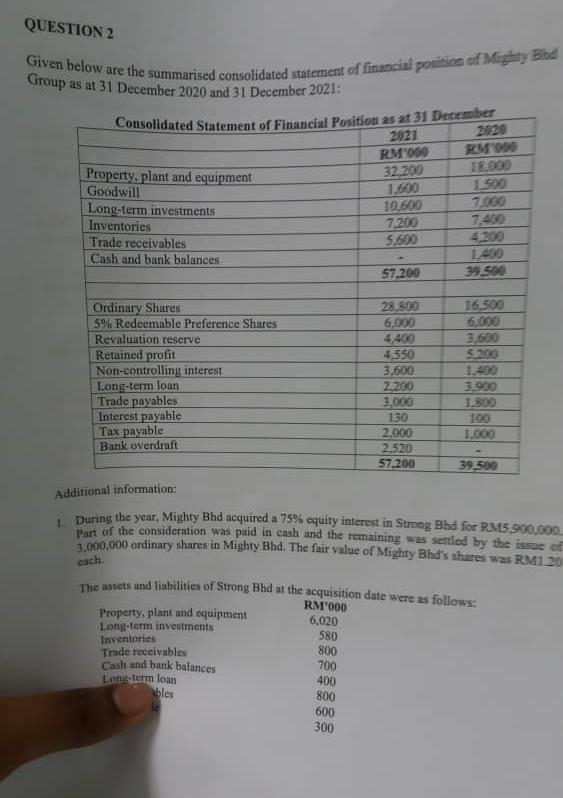

QUESTION 2 Given below are the summarised consolidated statement of financial position of Mighty Bod Group as at 31 December 2020 and 31 December 2021: Consolidated Statement of Financial Position as at 31 December 2921 2020 RM000 RS Property, plant and equipment 322200 18.000 Goodwill 1.600 1.500 Long-term investments 10.600 7.000 Inventories 7.200 7.490 Trade receivables 5.660 4200 Cash and bank balances 57,200 39.500 Ordinary Shares 28,800 16,500 5% Redeemable Preference Shares 6.900 Revaluation reserve Retained profit 4,550 5.200 Non-controlling interest 3.600 Long-term loan 2.200 3.900 Trade payables 2.000 1.800 Interest payable 130 Tax payable 2.000 1.000 Bank overdraft 2.520 57.200 39.500 Additional information: During the year, Mighty Bhd acquired a 75% equity interest in Strong B for RM5.900.000 part of the consideration was puid in cash and the remaining was settled by the issue of 3,000,000 ordinary shares in Mighty Bhd. The fair value of Mighty Bhd's shares was RM120 cuc. The anets and liabilities of Strong Bhd at the acquisition date were as follows: RM000 Property, plant and equipment 6,020 Long-term investments 580 Inventories 800 Trade receivables Cash and bank balances 700 Long term loan 400 bles 800 600 300 QUESTION 2 Given below are the summarised consolidated statement of financial position of Mighty Bod Group as at 31 December 2020 and 31 December 2021: Consolidated Statement of Financial Position as at 31 December 2921 2020 RM000 RS Property, plant and equipment 322200 18.000 Goodwill 1.600 1.500 Long-term investments 10.600 7.000 Inventories 7.200 7.490 Trade receivables 5.660 4200 Cash and bank balances 57,200 39.500 Ordinary Shares 28,800 16,500 5% Redeemable Preference Shares 6.900 Revaluation reserve Retained profit 4,550 5.200 Non-controlling interest 3.600 Long-term loan 2.200 3.900 Trade payables 2.000 1.800 Interest payable 130 Tax payable 2.000 1.000 Bank overdraft 2.520 57.200 39.500 Additional information: During the year, Mighty Bhd acquired a 75% equity interest in Strong B for RM5.900.000 part of the consideration was puid in cash and the remaining was settled by the issue of 3,000,000 ordinary shares in Mighty Bhd. The fair value of Mighty Bhd's shares was RM120 cuc. The anets and liabilities of Strong Bhd at the acquisition date were as follows: RM000 Property, plant and equipment 6,020 Long-term investments 580 Inventories 800 Trade receivables Cash and bank balances 700 Long term loan 400 bles 800 600 300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts