Question: I need answer for question#19 by the financial calculator Value 18. Present values and opportunity cost of capital Halcyon Lines is considering the pur- chase

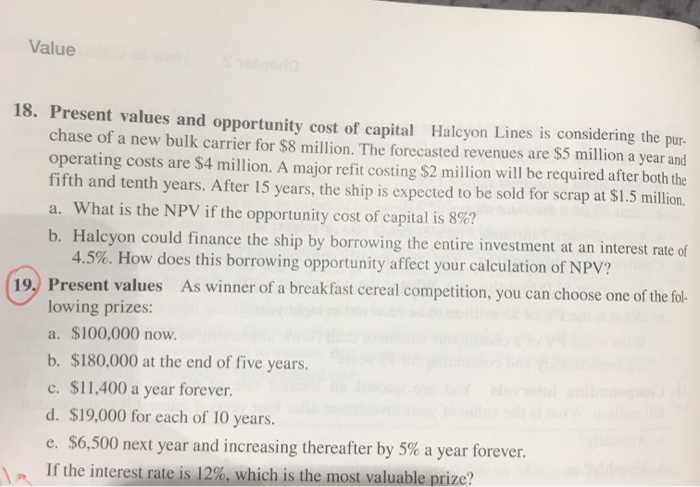

Value 18. Present values and opportunity cost of capital Halcyon Lines is considering the pur- chase of a new bulk carrier for $8 million. The forecasted revenues are $5 million a year and operating costs are $4 million. A major refit costing $2 million will be required after both the fifth and tenth years. After 15 years, the ship is expected to be sold for scrap at $1.5 million. a. What is the NPV if the opportunity cost of capital is 8%? b. Halcyon could finance the ship by borrowing the entire investment at an interest rate of 4.5%. How does this borrowing opportunity affect your calculation of NPV? 19. Present values As winner of a breakfast cereal competition, you can choose one of the fol- lowing prizes: a. $100,000 now. b. $180,000 at the end of five years. c. $11,400 a year forever. d. $19,000 for each of 10 years. e. $6,500 next year and increasing thereafter by 5% a year forever. If the interest rate is 12%, which is the most valuable prize

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts