Question: i need answer for this please asap Required information Siera, Lani, and Cecilia are partners in an equipment leasing business that has not been able

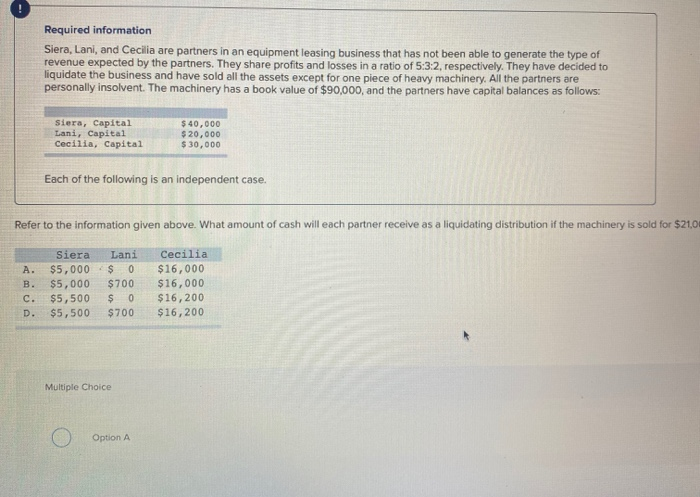

Required information Siera, Lani, and Cecilia are partners in an equipment leasing business that has not been able to generate the type of revenue expected by the partners. They share profits and losses in a ratio of 5:3:2, respectively. They have decided to liquidate the business and have sold all the assets except for one piece of heavy machinery. All the partners are personally insolvent. The machinery has a book value of $90,000, and the partners have capital balances as follows Siera, Capital Lani, Capital Cecilia, Capital $40.000 $20.000 $10.000 Each of the following is an independent case. Refer to the information given above. What amount of cash will each partner receive as a liquidating distribution if the machinery is sold for $21.0 B. c. D. Siera $5,000 $5,000 $5,500 $5,500 Lani $ 0 $700 $ 0 $700 Cecilia $16,000 $16,000 $16,200 $16,200 Multiple Choice C) Option A Required information r $21,00c . . . D. Siera 35,000 $5,000 $5,500 $5,500 Lani $ 0 $700 $ 0 $700 Cecilia $16,000 $16,000 $16,200 $16,200 Multiple Choice o o Option D o o Option B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts