Question: I need answer for this question it's urgent please. generate 15 pts) The following data present key ratios for eight well-known U.S. corporations for 2020:

I need answer for this question it's urgent please.

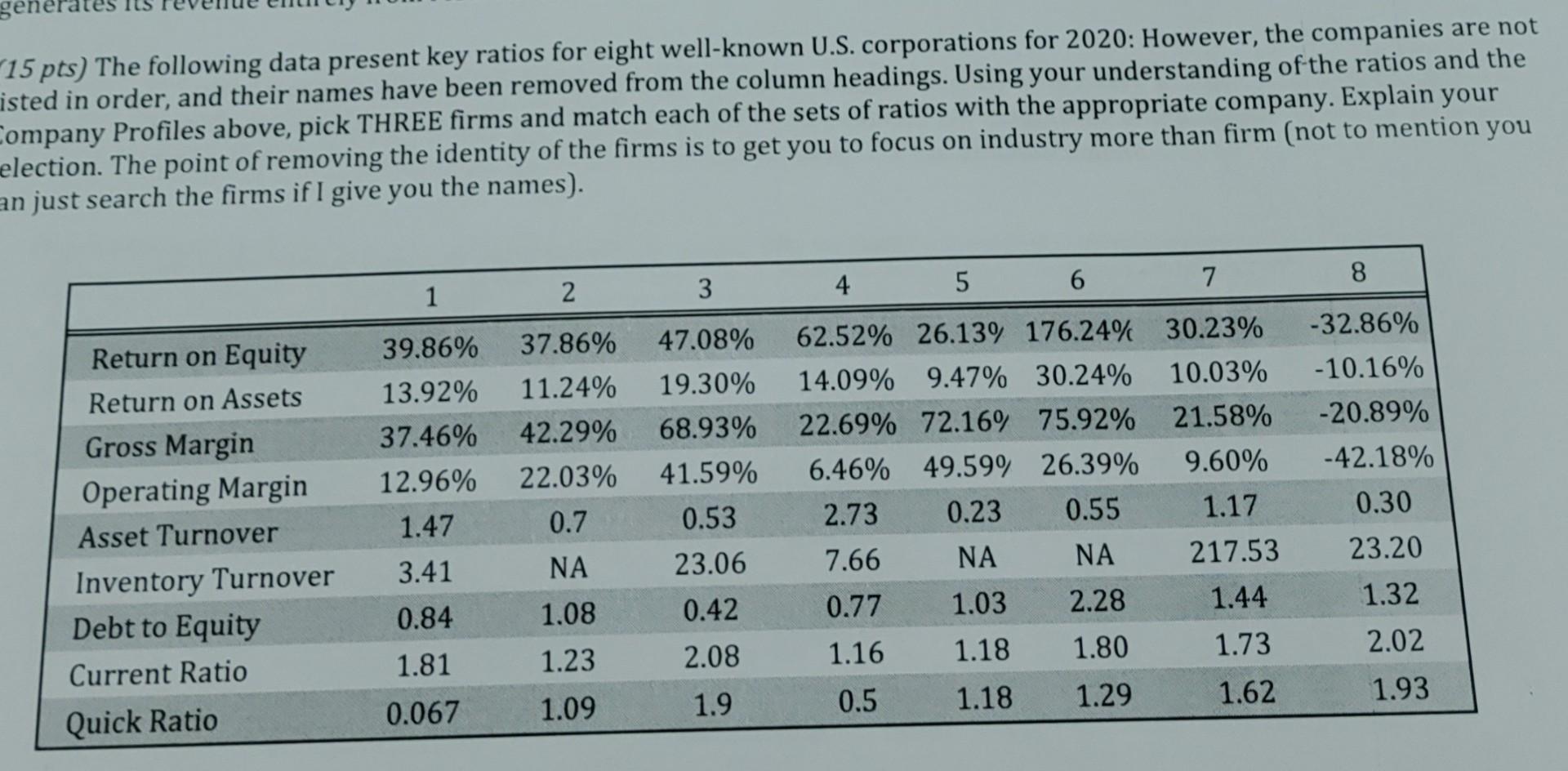

generate "15 pts) The following data present key ratios for eight well-known U.S. corporations for 2020: However, the companies are not isted in order, and their names have been removed from the column headings. Using your understanding of the ratios and the Company Profiles above, pick THREE firms and match each of the sets of ratios with the appropriate company. Explain your election. The point of removing the identity of the firms is to get you to focus on industry more than firm (not to mention you an just search the firms if I give you the names). 4 5 6 7 8 2 3 1 37.86% 11.24% 42.29% 22.03% 39.86% 13.92% 37.46% 12.96% 1.47 3.41 0.84 1.81 47.08% 19.30% 68.93% 41.59% 0.53 -32.86% -10.16% -20.89% -42.18% 0.30 Return on Equity Return on Assets Gross Margin Operating Margin Asset Turnover Inventory Turnover Debt to Equity Current Ratio Quick Ratio 62.52% 26.139 176.24% 30.23% 14.09% 9.47% 30.24% 10.03% 22.69% 72.16% 75.92% 21.58% 6.46% 49.599 26.39% 9.60% 2.73 0.23 0.55 1.17 7.66 NA NA 217.53 0.77 1.03 2.28 1.44 0.7 23.20 NA 23.06 1.32 1.08 0.42 2.08 1.16 1.18 1.80 1.23 1.73 2.02 0.5 1.9 1.18 1.29 1.09 1.62 1.93 0.067 generate "15 pts) The following data present key ratios for eight well-known U.S. corporations for 2020: However, the companies are not isted in order, and their names have been removed from the column headings. Using your understanding of the ratios and the Company Profiles above, pick THREE firms and match each of the sets of ratios with the appropriate company. Explain your election. The point of removing the identity of the firms is to get you to focus on industry more than firm (not to mention you an just search the firms if I give you the names). 4 5 6 7 8 2 3 1 37.86% 11.24% 42.29% 22.03% 39.86% 13.92% 37.46% 12.96% 1.47 3.41 0.84 1.81 47.08% 19.30% 68.93% 41.59% 0.53 -32.86% -10.16% -20.89% -42.18% 0.30 Return on Equity Return on Assets Gross Margin Operating Margin Asset Turnover Inventory Turnover Debt to Equity Current Ratio Quick Ratio 62.52% 26.139 176.24% 30.23% 14.09% 9.47% 30.24% 10.03% 22.69% 72.16% 75.92% 21.58% 6.46% 49.599 26.39% 9.60% 2.73 0.23 0.55 1.17 7.66 NA NA 217.53 0.77 1.03 2.28 1.44 0.7 23.20 NA 23.06 1.32 1.08 0.42 2.08 1.16 1.18 1.80 1.23 1.73 2.02 0.5 1.9 1.18 1.29 1.09 1.62 1.93 0.067

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts