Question: I need answer Q3 pls Example (3) Future Value of a Lump Sum You plan to invest $10,000 today in exchange for a fixed payment

I need answer Q3 pls

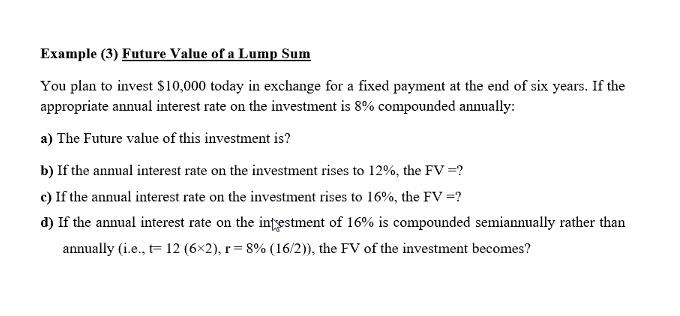

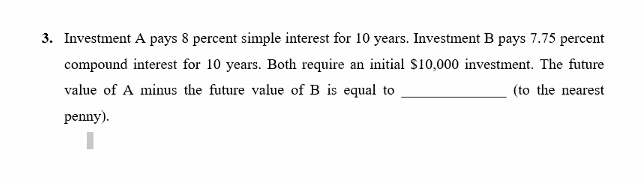

Example (3) Future Value of a Lump Sum You plan to invest $10,000 today in exchange for a fixed payment at the end of six years. If the appropriate annual interest rate on the investment is 8% compounded annually: a) The Future value of this investment is? b) If the annual interest rate on the investment rises to 12%, the FV =? c) If the annual interest rate on the investment rises to 16%, the FV =? d) If the annual interest rate on the infeestment of 16% is compounded semiannually rather than annually i.e., t= 12 (6x2),r=8% (16/2)), the FV of the investment becomes? 3. Investment A pays 8 percent simple interest for 10 years. Investment B pays 7.75 percent compound interest for 10 years. Both require an initial $10,000 investment. The future value of A minus the future value of B is equal to (to the nearest penny)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts