Question: I need the answer for example 2 Example (3) Future Value of a Lump Sum You plan to invest $10,000 today in exchange for a

I need the answer for example 2

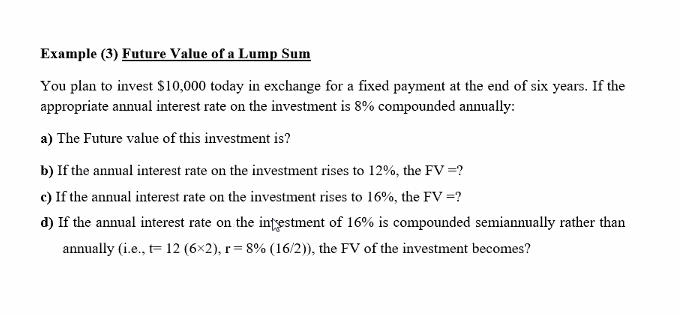

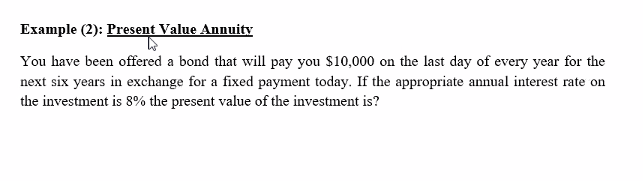

Example (3) Future Value of a Lump Sum You plan to invest $10,000 today in exchange for a fixed payment at the end of six years. If the appropriate annual interest rate on the investment is 8% compounded annually: a) The Future value of this investment is? b) If the annual interest rate on the investment rises to 12%, the FV =? c) If the annual interest rate on the investment rises to 16%, the FV =? d) If the annual interest rate on the infeestment of 16% is compounded semiannually rather than annually i.e., t= 12 (6x2),r=8% (16/2)), the FV of the investment becomes? Example (2): Present Value Annuity You have been offered a bond that will pay you $10,000 on the last day of every year for the next six years in exchange for a fixed payment today. If the appropriate annual interest rate on the investment is 8% the present value of the investment is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts