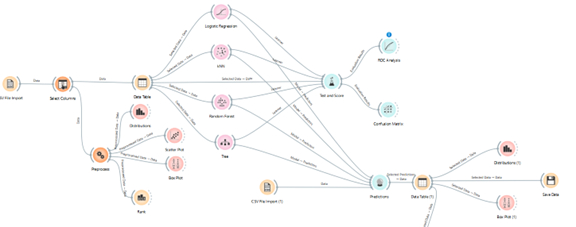

Question: I need assistance with illustrating Orange workflows to perform Task 1 and 2 outlined below ( I attached an image to explain I mean by

I need assistance with illustrating Orange workflows to perform Task and outlined below I attached an image to explain I mean by illustrating orange workflows as Im not familiar with using Orange:

IMPROVING SUBSCRIPTION TO BANK TERM DEPOSIT SERVICE

A bank has experienced a reduction in revenue and is unsure about the best course of action. Following an examination, they discovered the primary factor is their clients are not making deposits as regularly as they once did. With the use of term deposits, banks can keep deposits on hand for a predetermined period of time Therefore, the bank would prefer to identify current customers who are more likely to sign up for a term deposit and concentrate marketing efforts on such customers.

The assessment consists of two analytical tasks Task and Task :

Task : Based on the analysis from a number of marketing campaigns the bank performed, predict which of the existing clients are most likely to subscribe to a term deposit. The marketing campaigns were based on phone calls. Often, more than one contact with the same client was required. For this task, you are provided with two data files. The first one, MarketingCampaignsData.csv includes information about:

Various demographic information Customer account information Details about specific marketing campaign marketing campaign there were five in total, month and day of the week the customer was contacted, duration of the call in seconds and the contact outcome success or failure, outcome column

The last column called y tells if the customer has eventually subscribed to a term deposit yes or not no

Everything described above, with the exception of column y is contained in the second file, ExistingCustomers.csv which contains data about the bank's present clients. Using the information from the MarketingCampaignsData file as a foundation, try to foresee which of the bank's present clients is most likely to sign up for a term deposit. Determine who will subscribe, explain which criteria are most crucial for forecasting client membership to a term deposit, and pick the optimal prediction technique before creating a prediction model. Give a thorough justification of your analytical strategy, including the workflow model's components. Describe the steps taken to obtain the most accurate predictions. Give a thorough rundown of the results and expound on your conclusions.

Task : Once you have established who is most likely to subscribe to a term deposit, explore if different types of subscribers exist. More specifically, establish how many segments of subscribers there are, profile and name the identified segments, and recommend a marketing strategy for each segment. As in the previous task, elaborate on your approach and your findings.

All analyses must be performed in Orange Data Mining software.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock