Question: I need complete solution,Please post it's answer ASAP. Problem 2-7A Preparing and posting journal entries; preparing a trial balance LO3, 4, 5, 6 Elizabeth Wong

I need complete solution,Please post it's answer ASAP.

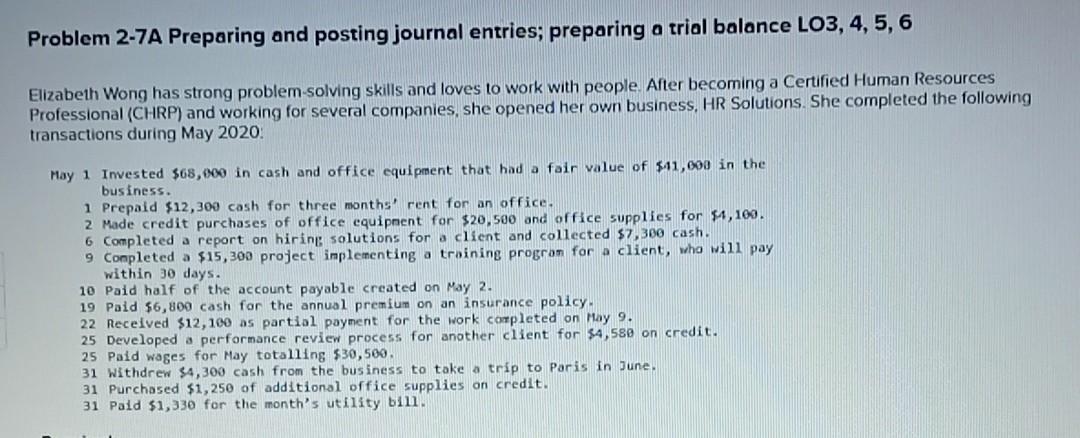

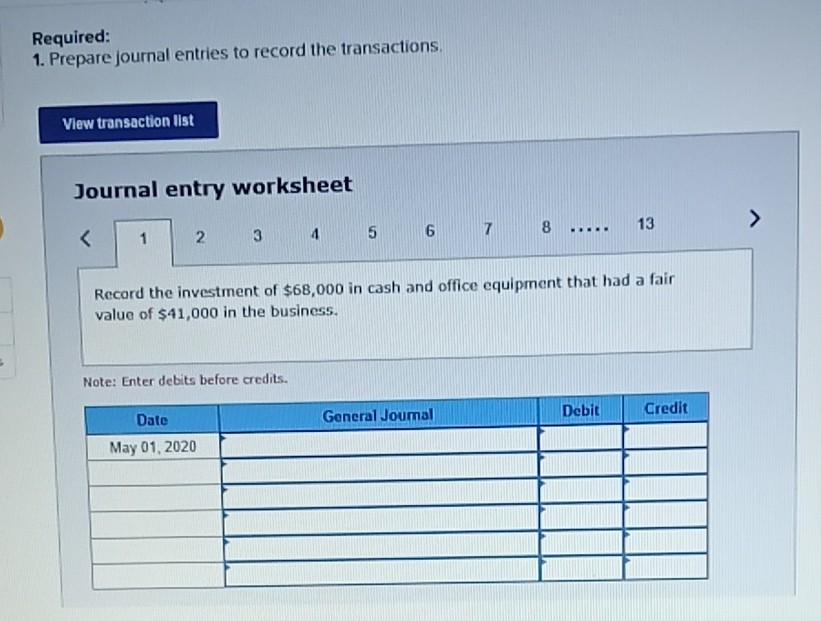

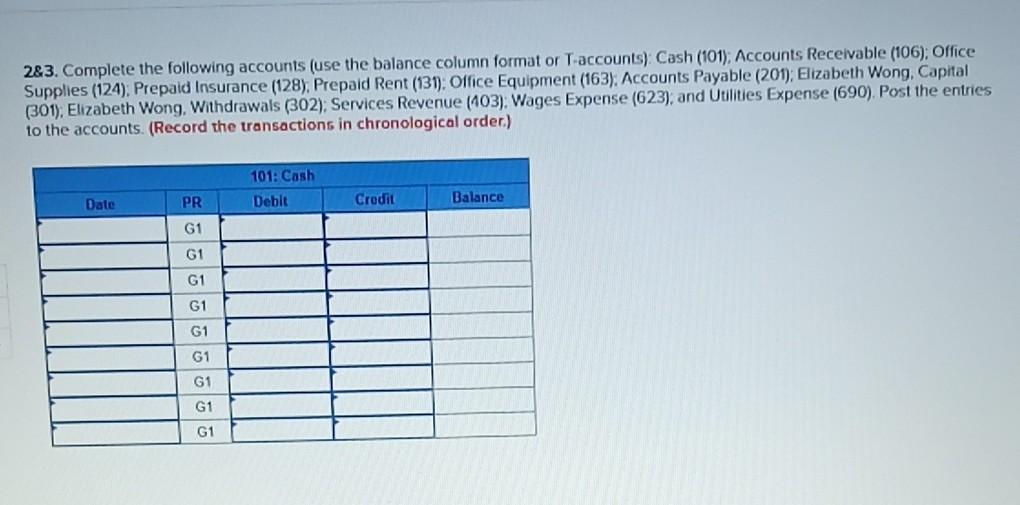

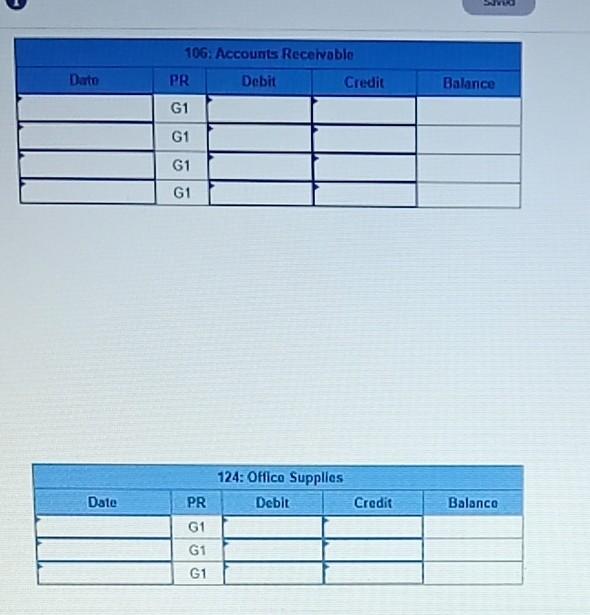

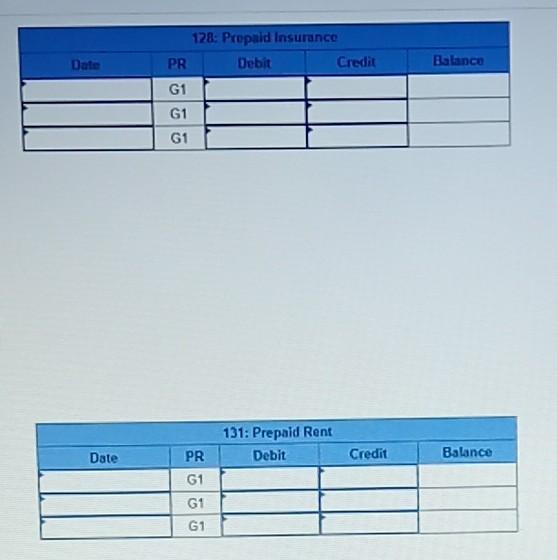

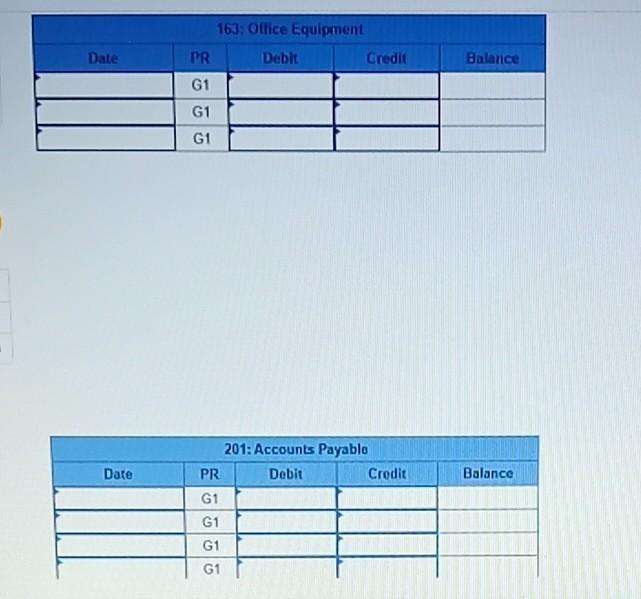

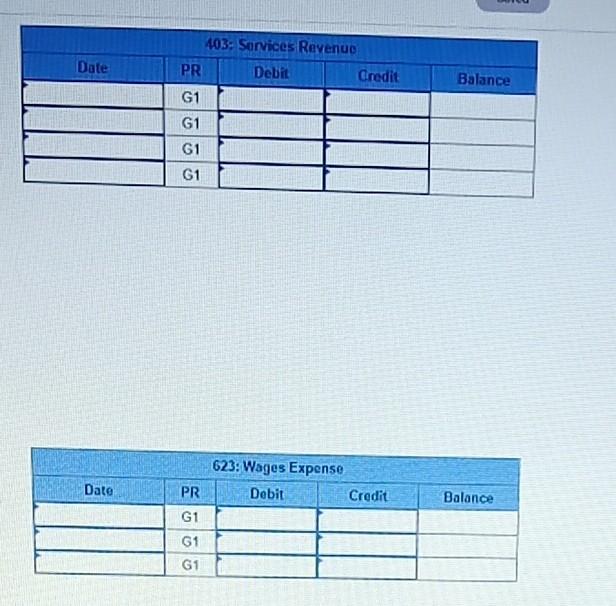

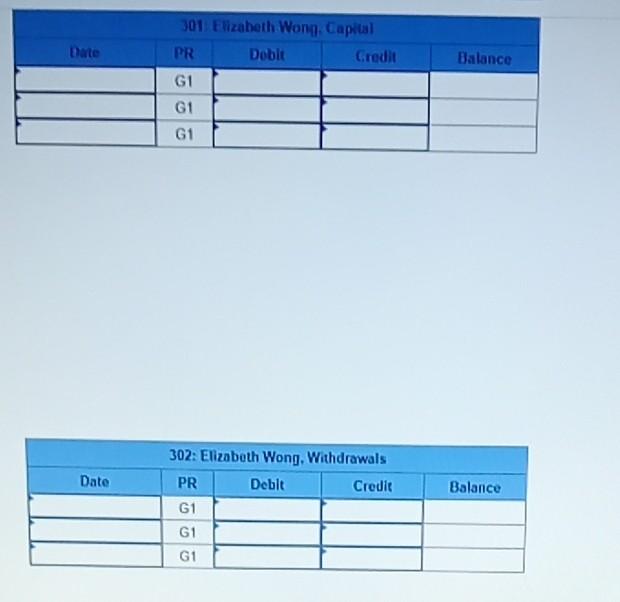

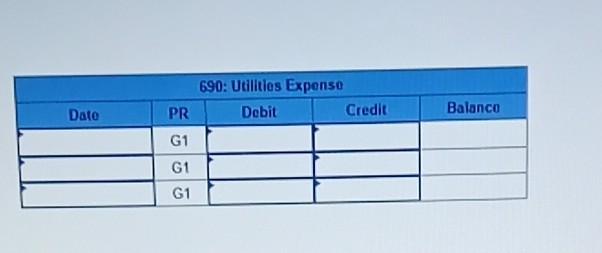

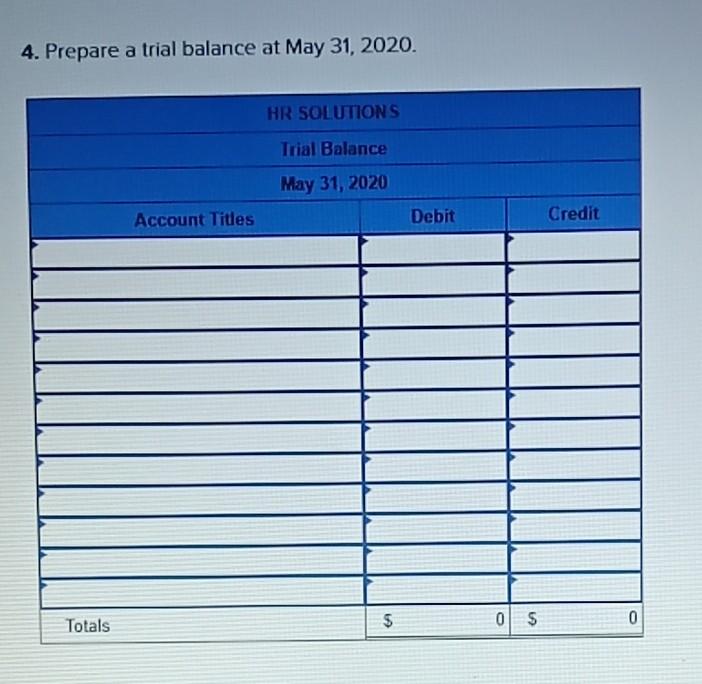

Problem 2-7A Preparing and posting journal entries; preparing a trial balance LO3, 4, 5, 6 Elizabeth Wong has strong problem-solving skills and loves to work with people. After becoming a Certified Human Resources Professional (CHRP) and working for several companies, she opened her own business, HR Solutions. She completed the following transactions during May 2020. May 1 Invested $68,000 in cash and office equipment that had a fair value of $41,000 in the business. 1 Prepaid $12,300 cash for three months' rent for an office. 2 Made credit purchases of office equipment for $20,500 and office supplies for $4,100. 6 Completed a report on hiring solutions for a client and collected $7,300 cash. 9 Completed a $15,300 project implementing a training program for a client, who will pay within 30 days. 10 Paid half of the account payable created on May 2. 19 Paid $6,800 cash for the annual premium on an insurance policy. 22 Received $12,100 as partial payment for the work completed on May 9. 25 Developed a performance review process for another client for $4,589 on credit. 25 Paid wages for May totalling $30,500 31 Withdrew $4,300 cash from the business to take a trip to Paris in June. 31 Purchased $1,250 of additional office supplies on credit. 31 Paid $1,330 for the month's utility bill. Required: 1. Prepare journal entries to record the transactions View transaction list Journal entry worksheet > 13 7 8 1 .... 2 5 4 6 3 Record the investment of $68,000 in cash and office equipment that had a fair value of $41,000 in the business. Note: Enter debits before credits. Date Credit Debit General Joumal May 01, 2020 283. Complete the following accounts (use the balance column format or T-accounts): Cash (101), Accounts Receivable (106) Office Supplies (124); Prepaid Insurance (128), Prepaid Rent (131): Office Equipment (163), Accounts Payable (201); Elizabeth Wong, Capital (301), Elizabeth Wong, Withdrawals (302); Services Revenue (403); Wages Expense (623), and Utilities Expense (690). Post the entries to the accounts (Record the transactions in chronological order) 101: Cash Debit Date PR Credit Balance G1 G1 G1 G1 G1 G1 G1 G1 G1 NIVO 106. Accounts Receivable PR Debit Credit Dato Balance G1 G1 G1 G1 124: Office Supplies Debit Date Credit Balanco PR G1 G1 G1 Date 128: Prepaid Insurance PR Debit Credit G1 Balance G1 G1 131: Prepaid Rent Debit Date Credit Balance PR G1 G1 G1 Date 163: Office Equipment PR Debit Credit G1 Balance G1 G1 Date Balance 201: Accounts Payablo PR Debit Credit G1 G1 G1 G1 Date Balance 403: Services Revenue PR Debit Credit G1 G1 G1 G1 623: Wages Expense Debit Date Credit Balance PR G1 61 G1 301 Elizabeth Wong. Capital PR Dobit Credit Date Balance G1 G1 G1 Date Balance 302: Elizabeth Wong. Withdrawals PR Debit Credit G1 G1 G1 690: Utilities Expenso Debit Credit Dato PR Balance G1 G1 G1 4. Prepare a trial balance at May 31, 2020. HR SOLUTIONS Trial Balance May 31, 2020 Account Titles Debit Credit Totals $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts