Question: Problem 2-7A Preparing and posting journal entries; preparing a trial balance LO3, 4, 5, 6 CHECK FIGURE: 4. Total Dr. = $176,230 Elizabeth Wong

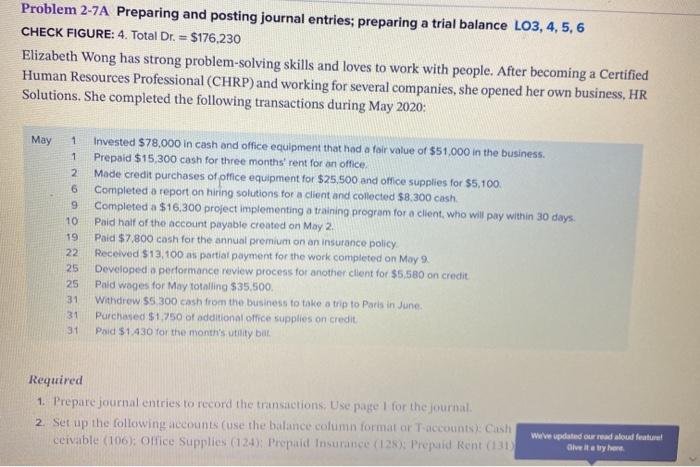

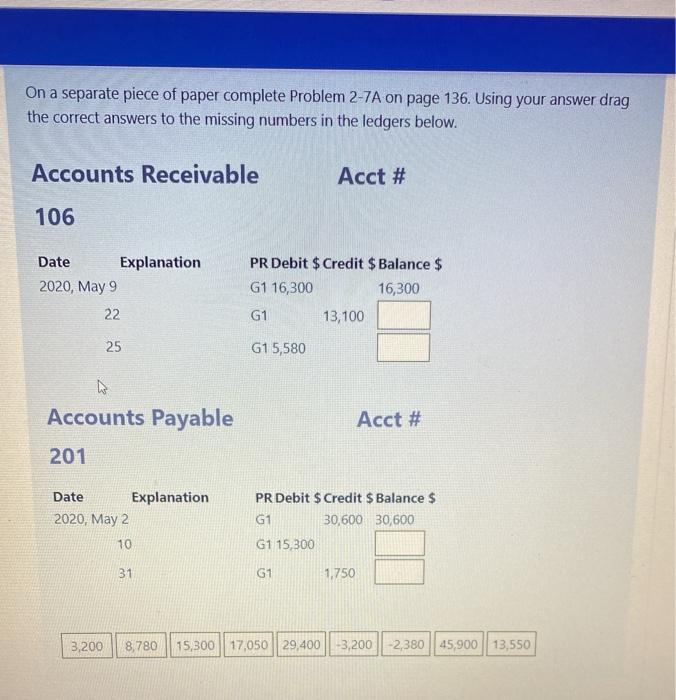

Problem 2-7A Preparing and posting journal entries; preparing a trial balance LO3, 4, 5, 6 CHECK FIGURE: 4. Total Dr. = $176,230 Elizabeth Wong has strong problem-solving skills and loves to work with people. After becoming a Certified Human Resources Professional (CHRP) and working for several companies, she opened her own business, HR Solutions. She completed the following transactions during May 2020: May 1 Invested $78,000 in cash and office equipment that had a fair value of $51,000 in the business. 1 Prepaid $15,300 cash for three months' rent for an office. 2 Made credit purchases of office equipment for $25.500 and office supplies for $5,100. 6 9 10 19 Paid $7,800 cash for the annual premium on an insurance policy. 22 25 25 31 31 31 Completed a report on hiring solutions for a client and collected $8.300 cash Completed a $16.300 project implementing a training program for a client, who will pay within 30 days. Paid half of the account payable created on May 2. Received $13,100 as partial payment for the work completed on May 9. Developed a performance review process for another client for $5,580 on credit Paid wages for May totalling $35.500. Withdrew $5.300 cash from the business to take a trip to Paris in June. Purchased $1,750 of additional office supplies on credit Paid $1,430 for the month's utility bill Required 1. Prepare journal entries to record the transactions. Use page 1 for the journal. 2. Set up the following accounts (use the balance column format or T-accounts): Cash ceivable (106): Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131) We've updated our read aloud feature Give it a try here On a separate piece of paper complete Problem 2-7A on page 136. Using your answer drag the correct answers to the missing numbers in the ledgers below. Accounts Receivable 106 Acct # Date Explanation PR Debit $ Credit $ Balance $ 2020, May 9 G1 16,300 16,300 22 G1 13,100 25 G15,580 Accounts Payable Acct # 201 Date Explanation PR Debit $ Credit $ Balance $ 2020, May 2 G1 30,600 30,600 10 G115,300 31 G1 1,750 3,200 8,780 15,300 17,050 29,400 -3,200 -2,380 45,900 13,550

Step by Step Solution

There are 3 Steps involved in it

To solve this problem well go through each transaction and prepare the journal entries Then well post these entries to the appropriate ledger accounts ... View full answer

Get step-by-step solutions from verified subject matter experts