Question: I need explanations Problem 5.10 Triangular Arbitrage Using the Swiss Franc The following exchange rates are available to you. (You can buy or sell at

I need explanations

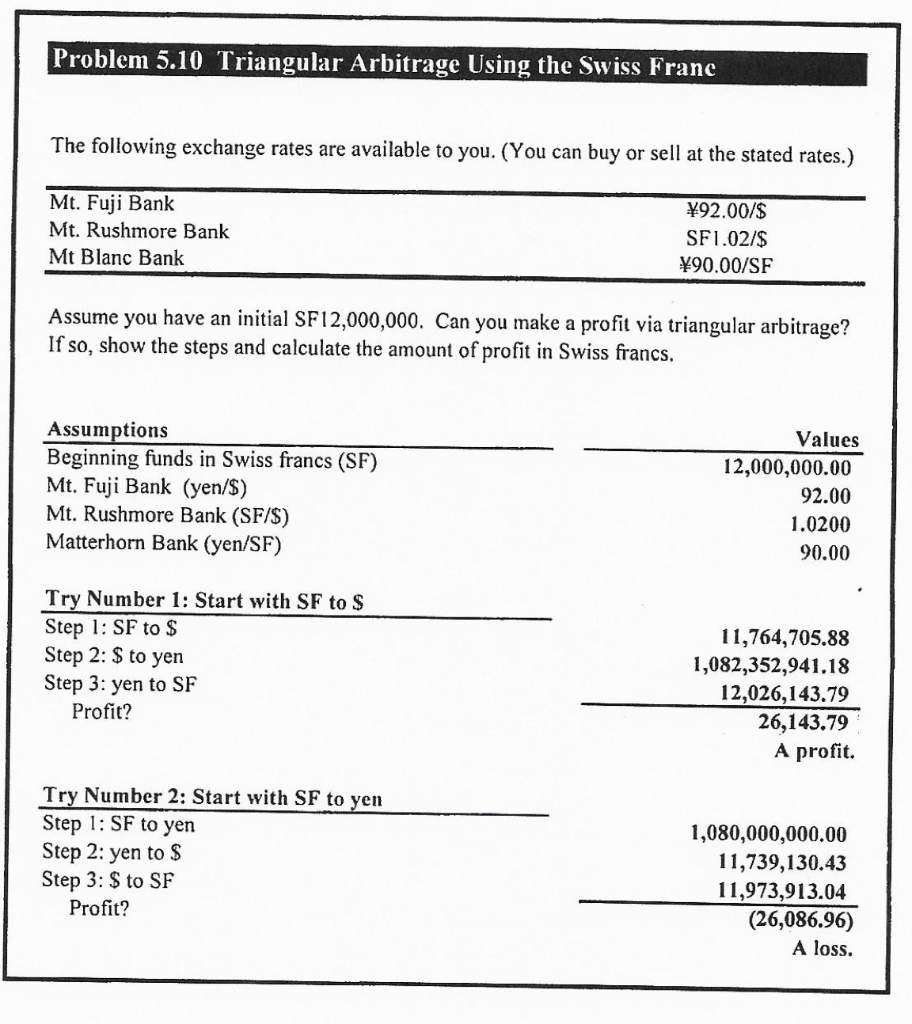

Problem 5.10 Triangular Arbitrage Using the Swiss Franc The following exchange rates are available to you. (You can buy or sell at the stated rates.) Mt. Fuji Bank Mt. Rushmore Bank Mt Blanc Bank 92.00/$ SF1.02/$ 90.00/SF Assume you have an initial SF12,000,000. Can you make a profit via triangular arbitrage? If so, show the steps and calculate the amount of profit in Swiss francs. Assumptions Beginning funds in Swiss francs (SF) Mt. Fuji Bank (yen/$) Mt. Rushmore Bank (SF/S) Matterhorn Bank (yen/SF) Values 12,000,000.00 92.00 1.0200 90.00 Try Number 1: Start with SF to $ Step 1: SF to $ Step 2: $ to yen Step 3: yen to SF Profit? 11,764,705.88 1,082,352,941.18 12,026,143.79 26,143.79 A profit. Try Number 2: Start with SF to yen Step 1: SF to yen Step 2: yen to $ Step 3: $ to SF Profit? 1,080,000,000.00 11,739,130.43 11,973,913.04 (26,086.96) A loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts