Question: I need explanations Problem 5.12 Transatlantic Arbitrage A corporate treasury working out of Vienna with operations in New York simultaneously calls Citibank in New York

I need explanations

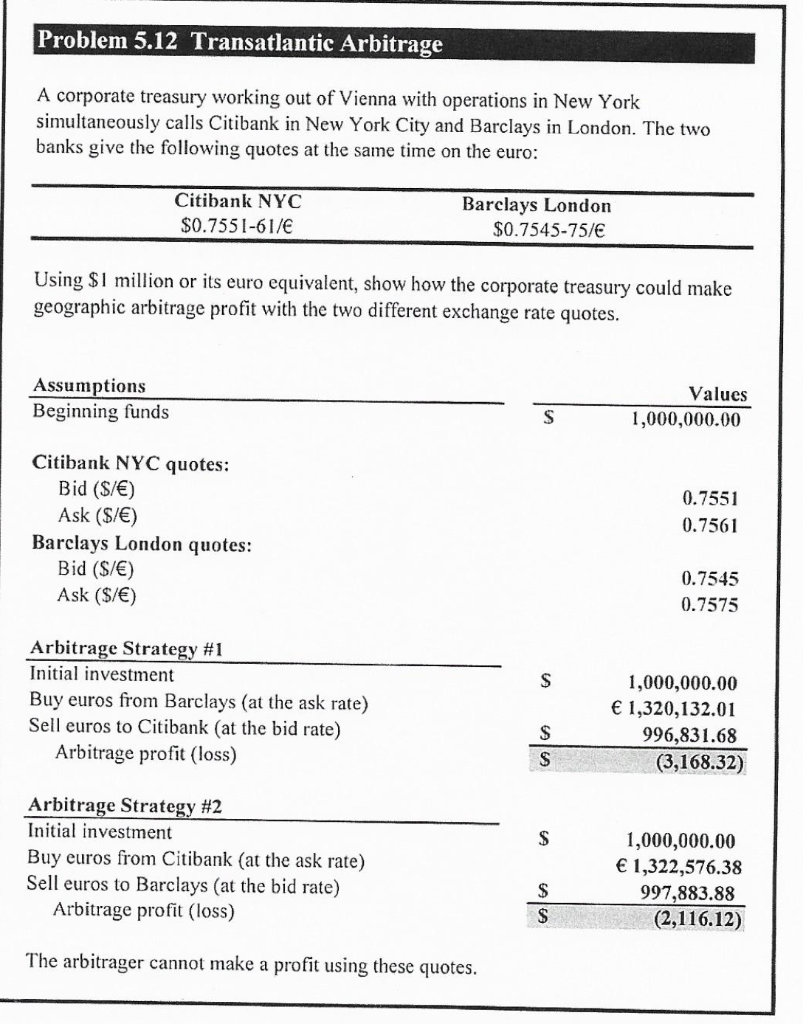

Problem 5.12 Transatlantic Arbitrage A corporate treasury working out of Vienna with operations in New York simultaneously calls Citibank in New York City and Barclays in London. The two banks give the following quotes at the same time on the euro: Citibank NYC $0.7551-61/ Barclays London $0.7545-75/6 Using $1 million or its euro equivalent, show how the corporate treasury could make geographic arbitrage profit with the two different exchange rate quotes. Assumptions Beginning funds Values 1,000,000.00 S Citibank NYC quotes: Bid ($/) Ask ($/) Barclays London quotes: Bid ($/) Ask ($/) 0.7551 0.7561 0.7545 0.7575 S Arbitrage Strategy #1 Initial investment Buy euros from Barclays (at the ask rate) Sell euros to Citibank (at the bid rate) Arbitrage profit (loss) 1,000,000.00 1,320,132.01 996,831.68 (3,168.32) $ $ S Arbitrage Strategy #2 Initial investment Buy euros from Citibank (at the ask rate) Sell euros to Barclays (at the bid rate) Arbitrage profit (loss) 1,000,000.00 1,322,576.38 997,883.88 (2,116.12) $ $ The arbitrager cannot make a profit using these quotes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts