Question: I need explanations/Excel formulas for every answerumber, thank you! Problem 9-4 Present Value and What If Analysis - See Textbook page 9-30 National Cruise Line,

I need explanations/Excel formulas for every answerumber, thank you!

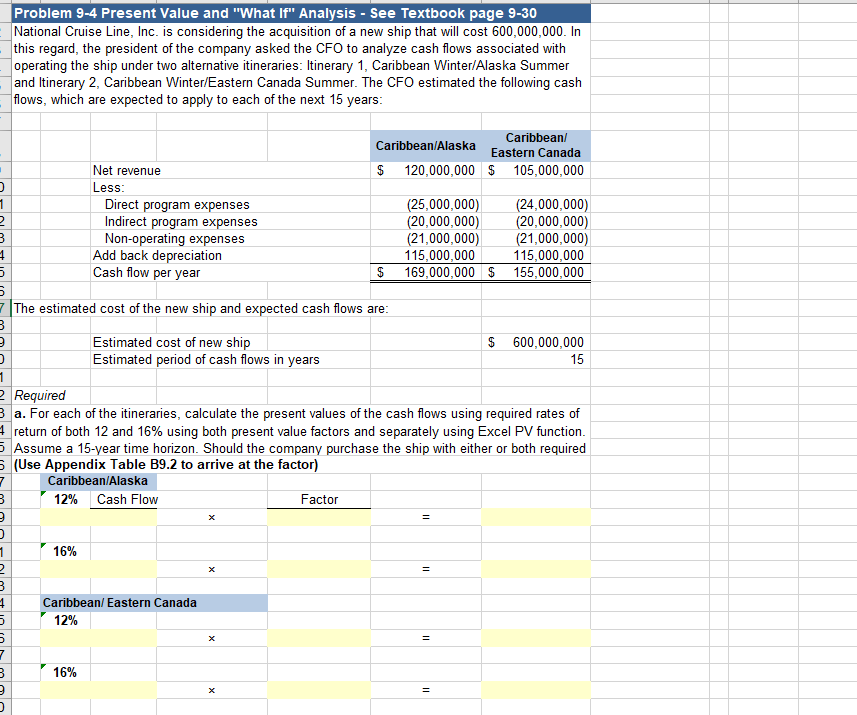

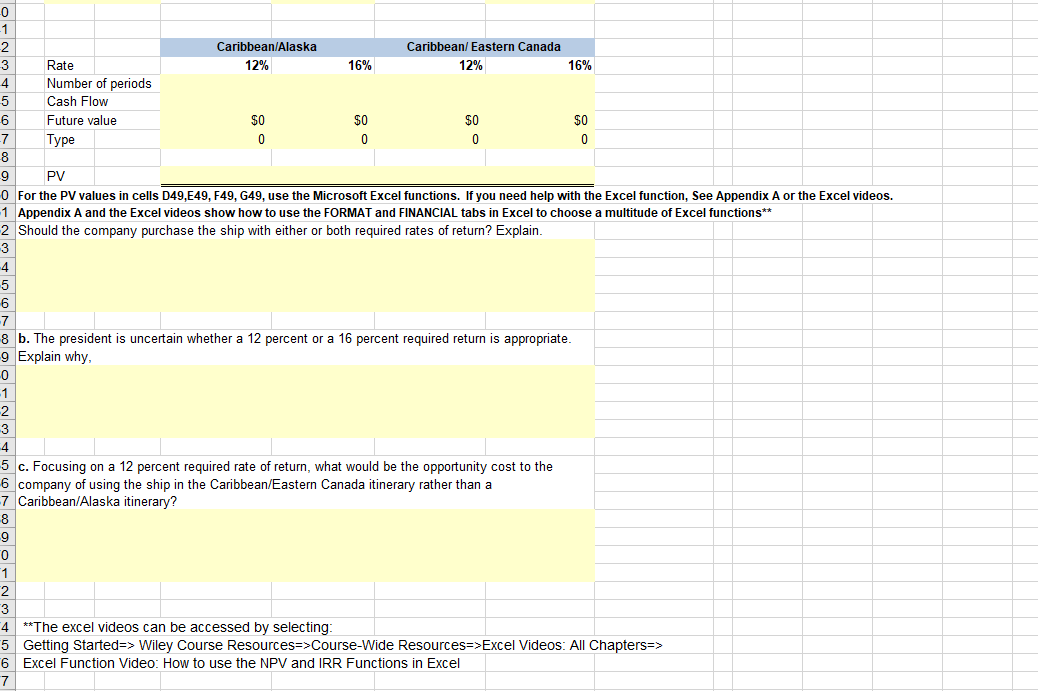

Problem 9-4 Present Value and "What If" Analysis - See Textbook page 9-30 National Cruise Line, Inc. is considering the acquisition of a new ship that will cost 600,000,000. In this regard, the president of the company asked the CFO to analyze cash flows associated with operating the ship under two alternative itineraries: Itinerary 1, Caribbean Winter/Alaska Summer and Itinerary 2, Caribbean Winter/Eastern Canada Summer. The CFO estimated the following cash flows, which are expected to apply to each of the next 15 years: The estimated cost of the new ship and expected cash flows are: Estimated cost of new ship Estimated period of cash flows in years $600,000,000 15 Required a. For each of the itineraries, calculate the present values of the cash flows using required rates of return of both 12 and 16% using both present value factors and separately using Excel PV function. Assume a 15-year time horizon. Should the company purchase the ship with either or both required (Use Appendix Table B9.2 to arrive at the factor) Caribbean/Alaska 16% Caribbean/ Eastern Canada 12% 16% Factor = = x =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts