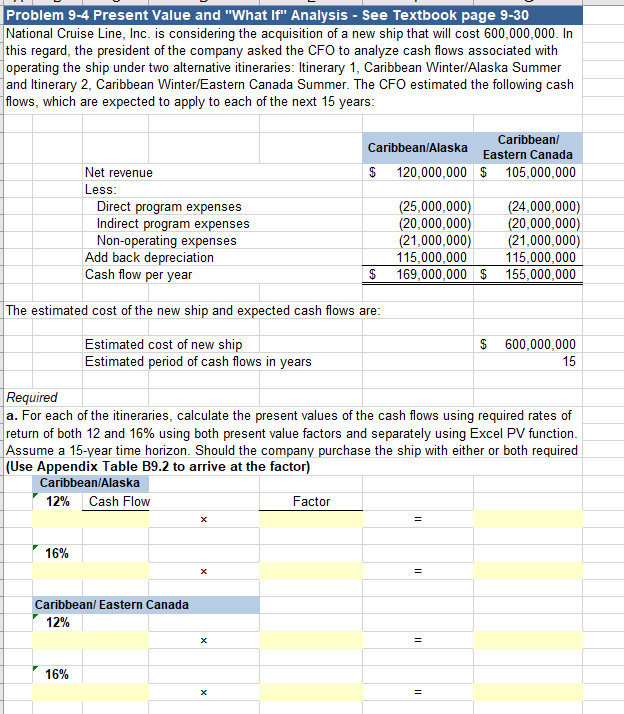

Question: Problem 9-4 Present Value and What If Analysis - See Textbook page 9-30 National Cruise Line, Inc. is considering the acquisition of a new ship

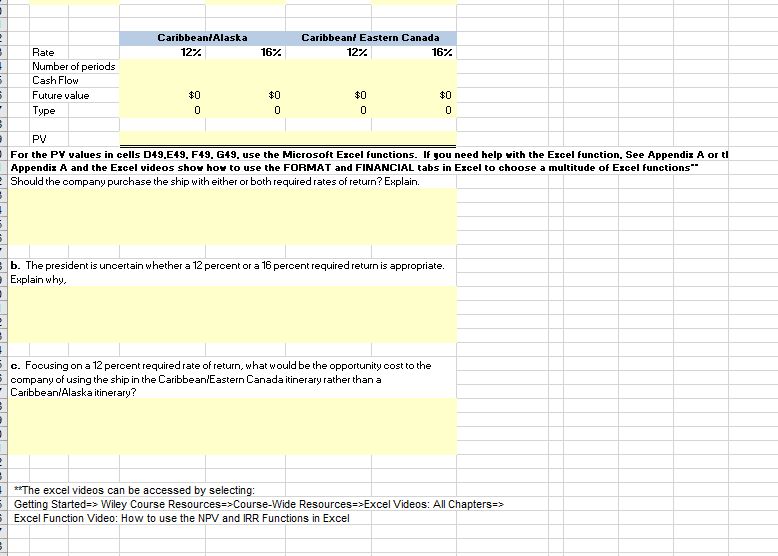

Problem 9-4 Present Value and "What If" Analysis - See Textbook page 9-30 National Cruise Line, Inc. is considering the acquisition of a new ship that will cost 600,000,000. In this regard, the president of the company asked the CFO to analyze cash flows associated with operating the ship under two alternative itineraries: Itinerary 1, Caribbean Winter/Alaska Summer and Itinerary 2, Caribbean Winter/Eastern Canada Summer. The CFO estimated the following cash flows, which are expected to apply to each of the next 15 years: The estimated cost of the new ship and expected cash flows are: Estimated cost of new ship Estimated period of cash flows in years $600,000,000 15 Required a. For each of the itineraries, calculate the present values of the cash flows using required rates of return of both 12 and 16% using both present value factors and separately using Excel PV function. Assume a 15-year time horizon. Should the company purchase the ship with either or both required (Use Appendix Table B9.2 to arrive at the factor) For the PY values in cells D49,E49. F49. G49. use the Microsoft Ezcel functions. If gou need help with the Ezcel function, See Appendiz A or tI Appendix A and the Excel videos show how to use the FORMAT and FINANCIAL tabs in Excel to choose a multitude of Excel functions" Should the company purchase the ship with either or both required rates of return? Explain. b. The president is uncertain whether a 12 percent or a 16 percent required return is appropriate. Explain why. c. Foousing on a 12 percent required rate of return, what would be the opportunity cost to the company of using the ship in the CaribbeaniEastern Canada itinerary rather than a CaribbeanAlaska itinerary? *x The excel videos can be accessed by selecting: Getting Started Wiley Course Resources Course-Wide Resources > Excel Videos: All Chapters > Excel Function Video: How to use the NPV and IRR Functions in Excel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts