Question: I need fixing the two columns I have got wrong, thanks :) A local company has just approached a venture capitalist for financing to develop

I need fixing the two columns I have got wrong, thanks :)

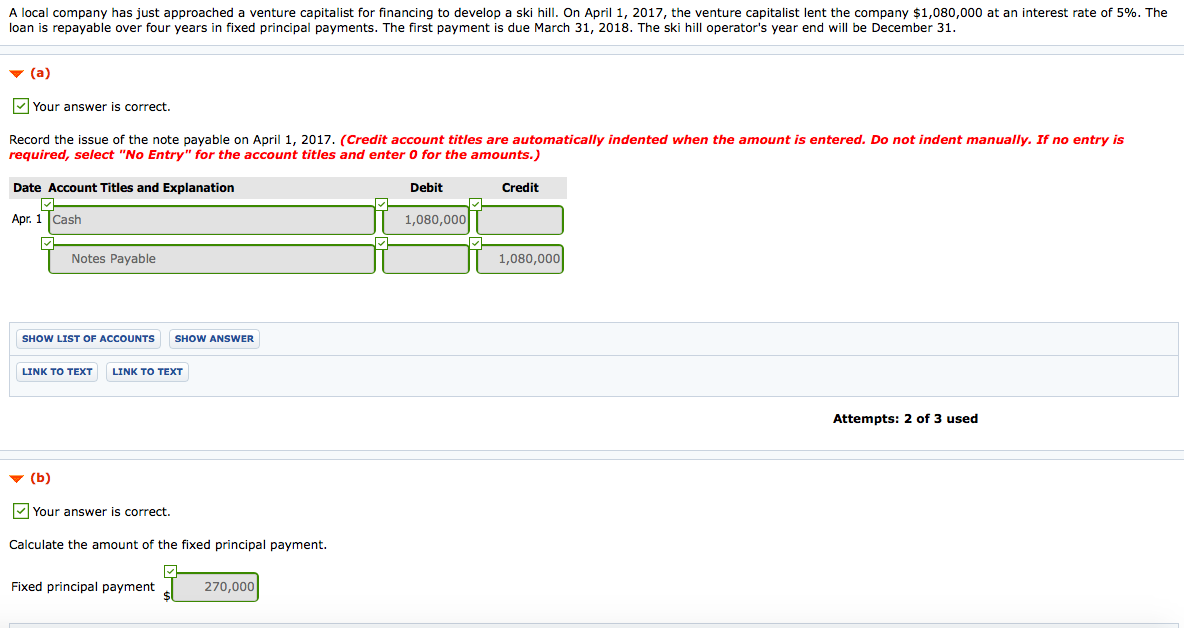

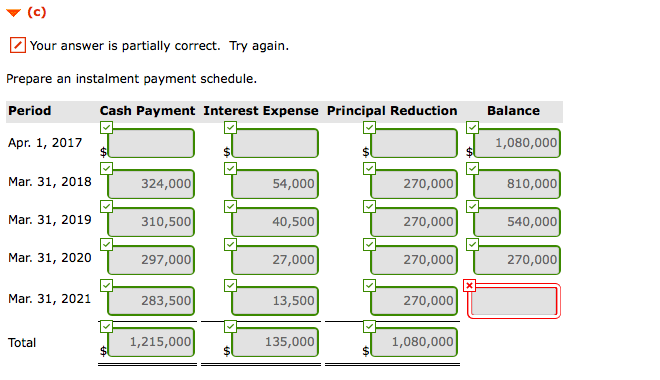

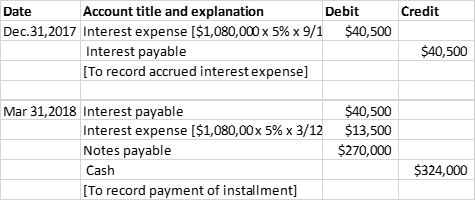

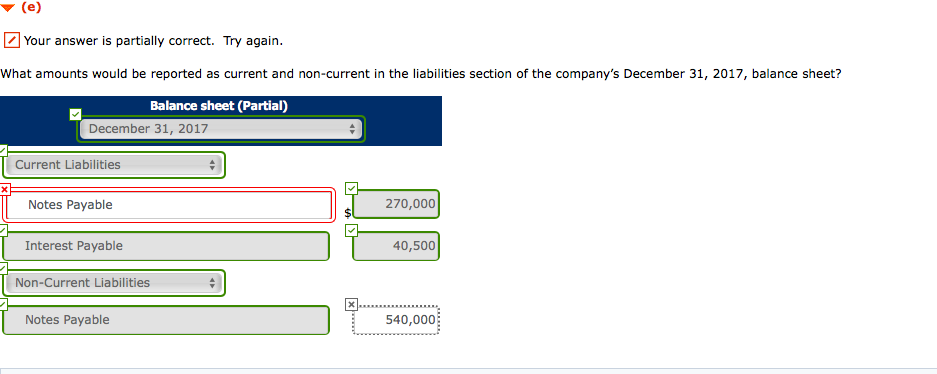

A local company has just approached a venture capitalist for financing to develop a ski hill. On April 1, 2017, the venture capitalist lent the company $1,080,000 at an interest rate of 5%. The loan is repayable over four years in fixed principal payments. The first payment is due March 31, 2018. The ski hill operator's year end will be December 31. (a) Your answer is correct. Record the issue of the note payable on April 1, 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Apr. 1 Cash 1,080,000 Notes Payable 1,080,000 SHOW LIST OF ACCOUNTS SHOW ANSWER LINK TO TEXT LINK TO TEXT Attempts: 2 of 3 used v (b) Your answer is correct. Calculate the amount of the fixed principal payment. Fixed principal payment 270,000 Your answer is partially correct. Try again. Prepare an instalment payment schedule. Period Cash Payment Interest Expense Principal Reduction Balance Apr 1, 2017 1,080,0001 Mar. 31, 2018 324,000 54,000 270,000 810,000 > Mar. 31, 2019 310,500 40,500 270,000 540,000 Mar. 31, 2020 297,000 27,000 270,000 270,000 > Mar. 31, 2021 283,500 13,500 270,000 Total 1,215,000 135,000 1,080,000 Credit Date Account title and explanation Debit Dec.31,2017 Interest expense ($1,080,000 x 5% x 9/1 $40,500 Interest payable [To record accrued interest expense] $40,500 Mar 31, 2018 Interest payable $40,500 Interest expense ($1,080,00 x 5% x 3/12 $13,500 Notes payable $270,000 Cash [To record payment of installment] $324,000 (e) Your answer is partially correct. Try again. What amounts would be reported as current and non-current in the liabilities section of the company's December 31, 2017, balance sheet? Balance sheet (Partial) December 31, 2017 Current Liabilities Notes Payable 270,000 Interest Payable 40,500 Non-Current Liabilities Notes Payable 540,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts