Question: I need full answers with solution. Section A) (45 marks) An insurance company provides life insurance to elderly customers 70 years old and above. The

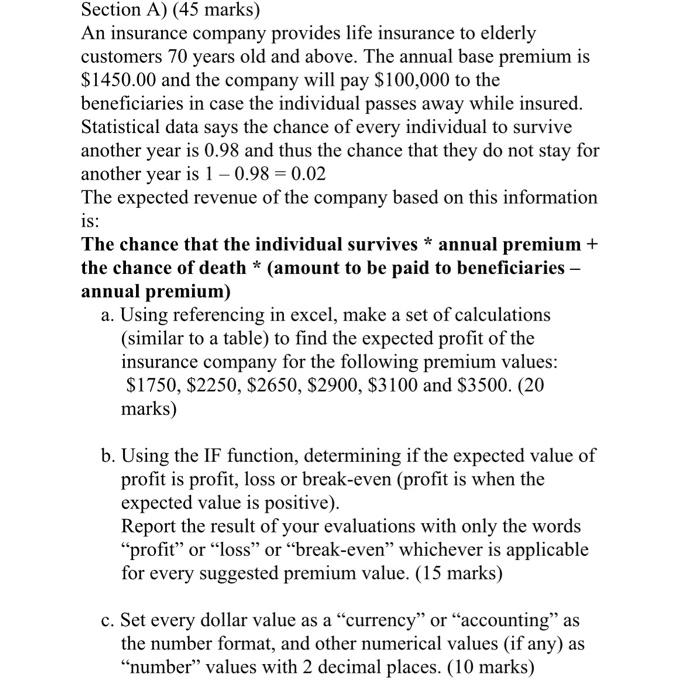

Section A) (45 marks) An insurance company provides life insurance to elderly customers 70 years old and above. The annual base premium is $1450.00 and the company will pay $100,000 to the beneficiaries in case the individual passes away while insured. Statistical data says the chance of every individual to survive another year is 0.98 and thus the chance that they do not stay for another year is 1 - 0.98 = 0.02 The expected revenue of the company based on this information is: The chance that the individual survives * annual premium + the chance of death * (amount to be paid to beneficiaries - annual premium) a. Using referencing in excel, make a set of calculations (similar to a table) to find the expected profit of the insurance company for the following premium values: $1750, $2250, $2650, $2900, $3100 and $3500. (20 marks) b. Using the IF function, determining if the expected value of profit is profit, loss or break-even (profit is when the expected value is positive). Report the result of your evaluations with only the words "profit" or "loss" or "break-even" whichever is applicable for every suggested premium value. (15 marks) c. Set every dollar value as a "currency" or "accounting" as the number format, and other numerical values (if any) as "number" values with 2 decimal places. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts