Question: i need full mark in this question please my dear experts. Question 3 (15 points - 5 points each) In each of the following cases,

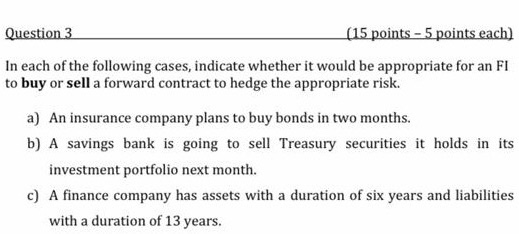

Question 3 (15 points - 5 points each) In each of the following cases, indicate whether it would be appropriate for an FI to buy or sell a forward contract to hedge the appropriate risk. a) An insurance company plans to buy bonds in two months. b) A savings bank is going to sell Treasury securities it holds in its investment portfolio next month. c) A finance company has assets with a duration of six years and liabilities with a duration of 13 years. Question 3 (15 points - 5 points each) In each of the following cases, indicate whether it would be appropriate for an FI to buy or sell a forward contract to hedge the appropriate risk. a) An insurance company plans to buy bonds in two months. b) A savings bank is going to sell Treasury securities it holds in its investment portfolio next month. c) A finance company has assets with a duration of six years and liabilities with a duration of 13 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts