Question: I need full work shown for this problem please!! Im looking for the Interest cost capitalized and the weighted-average accumulated expenditures!!! Date 4. On March

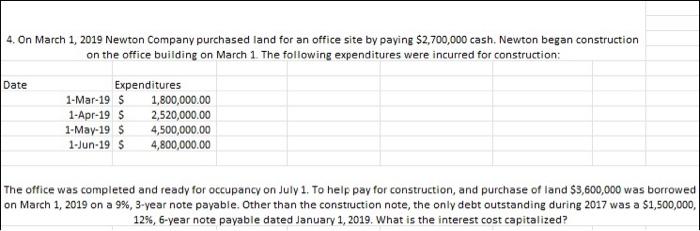

Date 4. On March 1, 2019 Newton Company purchased land for an office site by paying $2,700,000 cash. Newton began construction on the office building on March 1. The following expenditures were incurred for construction: Expenditures 1-Mar-19 $ 1,800,000.00 1-Apr-19 S 2,520,000.00 1-May-19 $ 4,500,000.00 1-Jun-19 $ 4,800,000.00 The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $3,600,000 was borrowed on March 1, 2019 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2017 was a $1,500,000, 12%, 6-year note payable dated January 1, 2019. What is the interest cost capitalized? Date 4. On March 1, 2019 Newton Company purchased land for an office site by paying $2,700,000 cash. Newton began construction on the office building on March 1. The following expenditures were incurred for construction: Expenditures 1-Mar-19 $ 1,800,000.00 1-Apr-19 S 2,520,000.00 1-May-19 $ 4,500,000.00 1-Jun-19 $ 4,800,000.00 The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $3,600,000 was borrowed on March 1, 2019 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2017 was a $1,500,000, 12%, 6-year note payable dated January 1, 2019. What is the interest cost capitalized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts