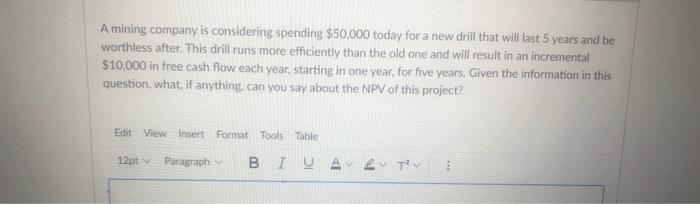

Question: i need help A mining company is considering spending $50,000 today for a new drill that will last 5 years and be worthless after. This

i need help

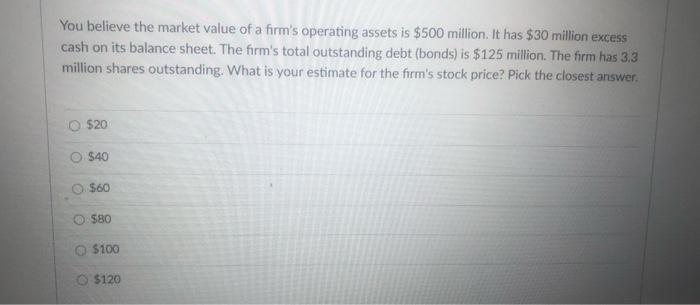

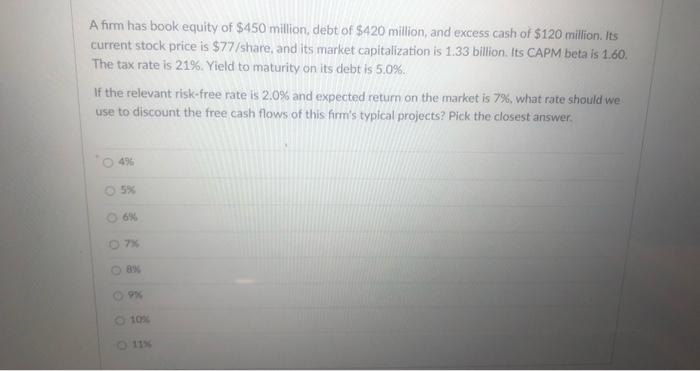

i need helpA mining company is considering spending $50,000 today for a new drill that will last 5 years and be worthless after. This drill runs more efficiently than the old one and will result in an incremental $10,000 in free cash flow each year, starting in one year, for five years. Given the information in this question, what if anything, can you say about the NPV of this project? Edit View Insert Format Tools Table 12ptv Paragraph You believe the market value of a firm's operating assets is $500 million. It has $30 million excess cash on its balance sheet. The firm's total outstanding debt (bonds) is $125 million. The firm has 3,3 million shares outstanding. What is your estimate for the firm's stock price? Pick the closest answer. $20 $40 O $60 $80 $100 $120 A firm has book equity of $450 million, debt of $420 million, and excess cash of $120 million. Its current stock price is $77/share, and its market capitalization is 1.33 billion. Its CAPM beta is 1.60. The tax rate is 21%. Yield to maturity on its debt is 5.0%. If the relevant risk-free rate is 2.0% and expected retum on the market is 7%, what rate should we use to discount the free cash flows of this firm's typical projects? Pick the closest answer 49 6% 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts