Question: I need help answering this please: For the base case in this section, as a percentage of sales, COGS = 70 percent, SGA = 14

I need help answering this please:

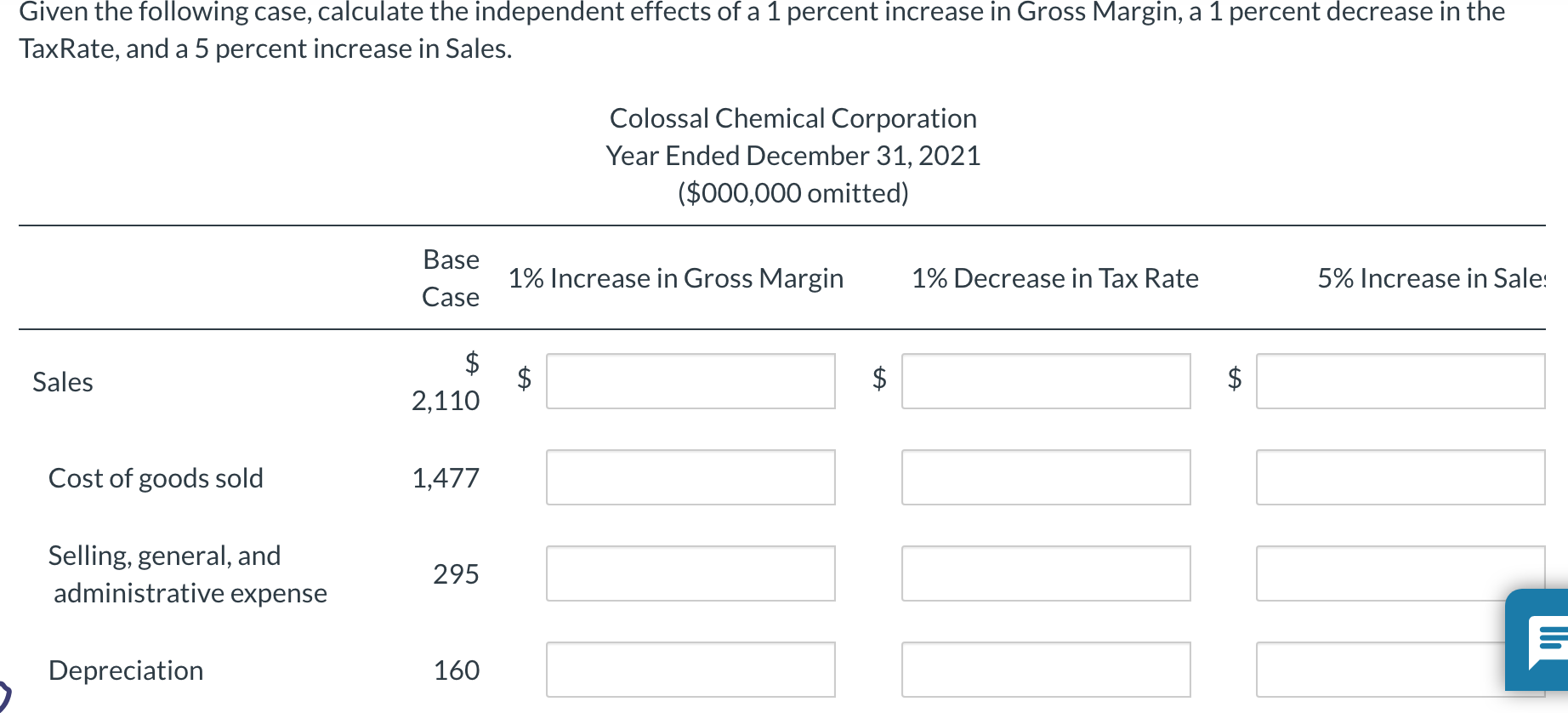

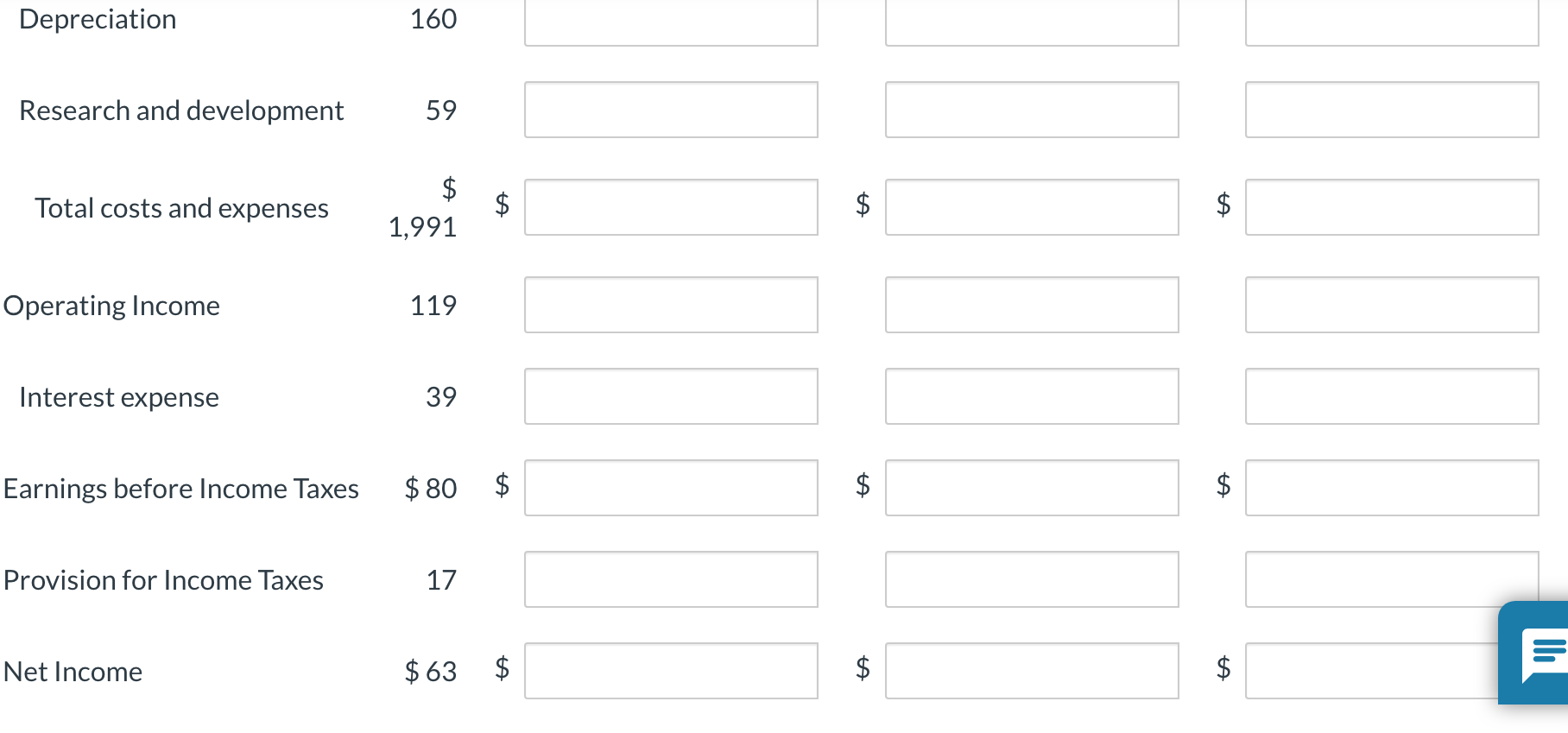

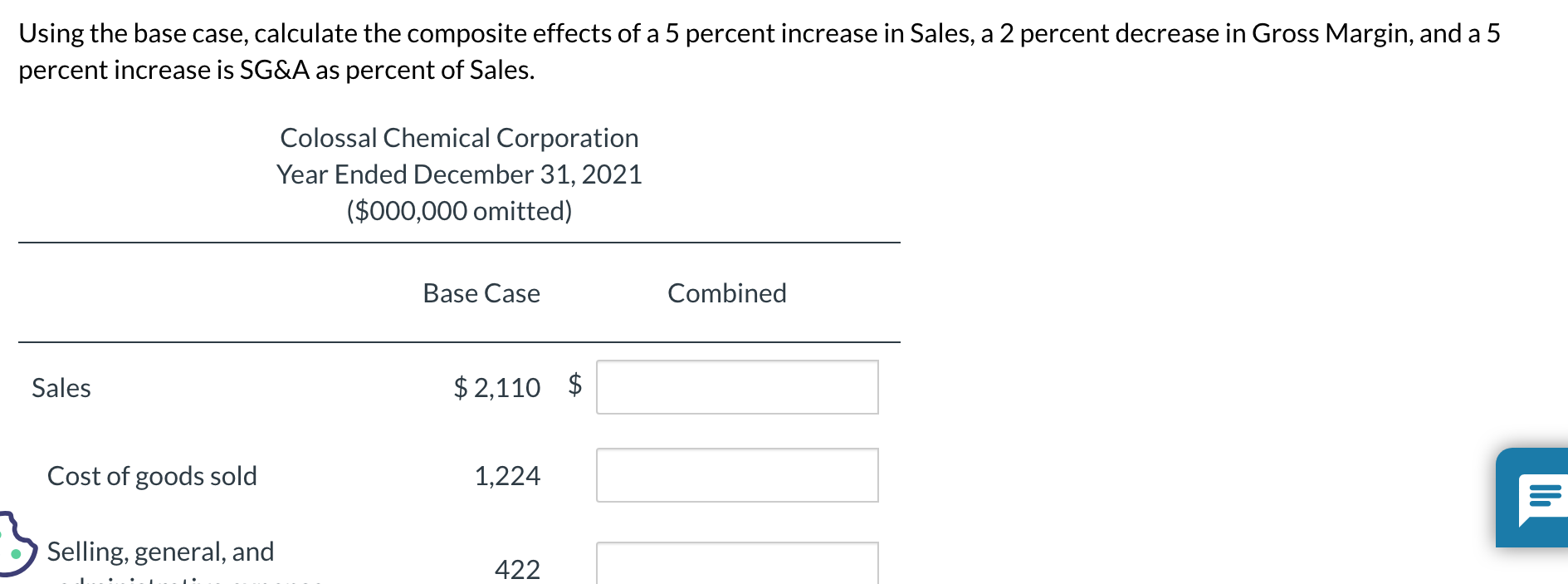

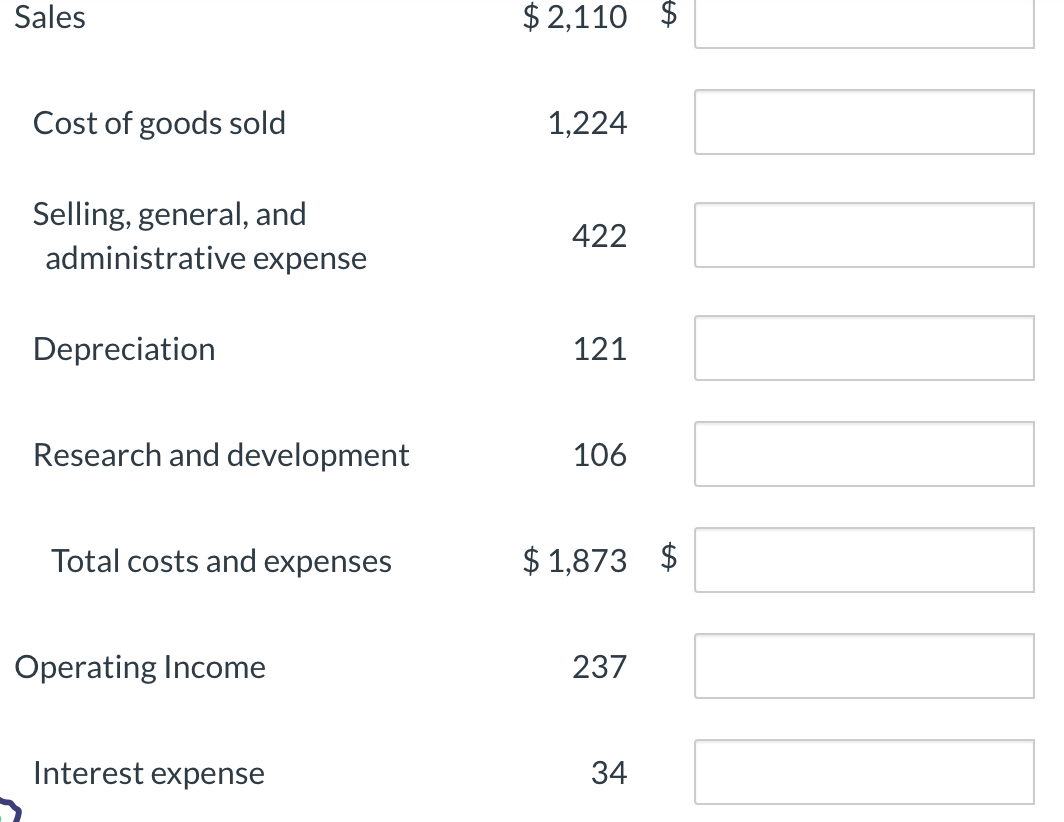

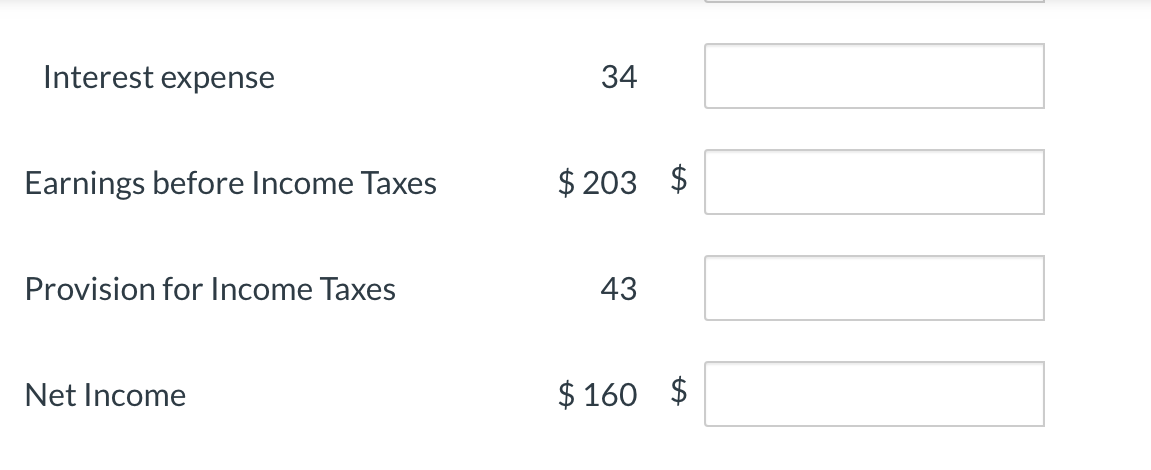

For the base case in this section, as a percentage of sales, COGS = 70 percent, SGA = 14 percent, R&D=2.8 percent. Depreciation, Interest expense are fixed as stated. Tax Rate is 21 percent. Interest expense 34 Earnings before Income Taxes $203$ Provision for Income Taxes 43 Net Income $160$ Given the following case, calculate the independent effects of a 1 percent increase in Gross Margin, a 1 percent decrease in the TaxRate, and a 5 percent increase in Sales. Using the base case, calculate the composite effects of a 5 percent increase in Sales, a 2 percent decrease in Gross Margin, and a 5 percent increase is SG\&A as percent of Sales. Depreciation Research and development Total costs and expenses Operating Income Interest expense Earnings before Income Taxes $80$ Provision for Income Taxes Net Income 59 $ 1,991 119 39 17 $63$ $ $ $ $ $ $ Sales $2,110$ Cost of goods sold Selling, general, and administrative expense Depreciation Research and development Total costs and expenses Operating Income Interest expense 1,224 422 121 106 $1,873$ 237 34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts