Question: I need help as soon as possible thank you! Quantitative Problem: Sunshine Smoothies Company (SSC) manufactures and distributes smoothies. SSC is considering the development of

I need help as soon as possible thank you!

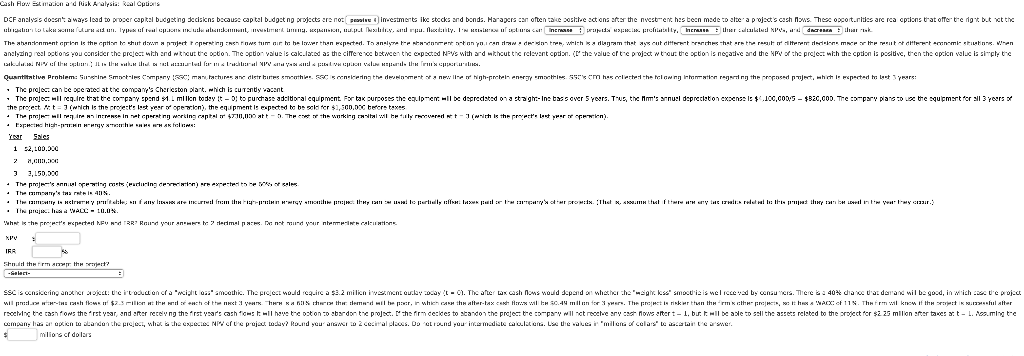

Quantitative Problem: Sunshine Smoothies Company (SSC) manufactures and distributes smoothies. SSC is considering the development of a new line of high-protein energy smoothies. SSC's CFO has collected the following information regarding the proposed project, which is expected to last 3 years:

- The project can be operated at the company's Charleston plant, which is currently vacant.

- The project will require that the company spend $4.1 million today (t = 0) to purchase additional equipment. For tax purposes the equipment will be depreciated on a straight-line basis over 5 years. Thus, the firm's annual depreciation expense is $4,100,000/5 = $820,000. The company plans to use the equipment for all 3 years of the project. At t = 3 (which is the project's last year of operation), the equipment is expected to be sold for $1,500,000 before taxes.

- The project will require an increase in net operating working capital of $730,000 at t = 0. The cost of the working capital will be fully recovered at t = 3 (which is the project's last year of operation).

- Expected high-protein energy smoothie sales are as follows:

Year Sales 1 $2,100,000 2 8,000,000 3 3,150,000 - The project's annual operating costs (excluding depreciation) are expected to be 60% of sales.

- The company's tax rate is 40%.

- The company is extremely profitable; so if any losses are incurred from the high-protein energy smoothie project they can be used to partially offset taxes paid on the company's other projects. (That is, assume that if there are any tax credits related to this project they can be used in the year they occur.)

- The project has a WACC = 10.0%.

What is the project's expected NPV and IRR? Round your answers to 2 decimal places. Do not round your intermediate calculations.

| NPV | $ |

| IRR | % |

Should the firm accept the project? -Select-The firm should accept the project.The firm should not accept the project.Correct 7 of Item 1

SSC is considering another project: the introduction of a "weight loss" smoothie. The project would require a $3.2 million investment outlay today (t = 0). The after-tax cash flows would depend on whether the "weight loss" smoothie is well received by consumers. There is a 40% chance that demand will be good, in which case the project will produce after-tax cash flows of $2.3 million at the end of each of the next 3 years. There is a 60% chance that demand will be poor, in which case the after-tax cash flows will be $0.49 million for 3 years. The project is riskier than the firm's other projects, so it has a WACC of 11%. The firm will know if the project is successful after receiving the cash flows the first year, and after receiving the first year's cash flows it will have the option to abandon the project. If the firm decides to abandon the project the company will not receive any cash flows after t = 1, but it will be able to sell the assets related to the project for $2.25 million after taxes at t = 1. Assuming the company has an option to abandon the project, what is the expected NPV of the project today? Round your answer to 2 decimal places. Do not round your intermediate calculations. Use the values in "millions of dollars" to ascertain the answer. $ millions of dollars

Cash How raicn a d Rick & alesia: 3eal Cutiaes DCF an:lyss docent a ways lead to procer captal budgating decisions bccause captal b.dget ng projects are not (pesolae ) in-westments ike stcdcks and bonds. Harapcrs can often taue costhve act ons ater the nvestrent hes becn made to albera projects cash ows Thec opport.ridcs are rea cpins trat offe tre igt but ct the The wbandenment crien in cntioc to stuut dawn a ndert t cnecaticn as rnws tum ac bo be lacer then rsneted. Ta an-lsze tre scancarcert artan xn.ican dw. decan tren. weich isa dianramt Cut ditterect rscctes dterec dediogs macec tte resut ct dtterect orncmi stuetans, hen t are the resut the value of the pojct wtou: the opton is negative and the Py ofthe prcjec mth the cpion i pesitve, trenthe opcion valuc is simply the anclyzing real ctons you consider the prcject wth and wthcut the option The aption value is calk.lated as the ciffe enoc batwcen the epctod Nvs with ard wthout the relevant cpion. h-prcbein enerT macti SSr's cm has celerted the hel cw ng ichomation regard og the propased pujet, h rh i pected lt3years .-....... .The pralec can te cearec at the compane's Chericston plart, ehich ia curnty vacnt caloecl be decredated ona stagh- In tassover 5 vear. Tun the im's arnusl depreciston expense ls 10C ,coD5 $820,0OD. Tre comparY plansto ue the squipmert for l 3yeers s the crerts at vesr ecrenricn thean iment is ly rered t-(irh le the prorert'e let er roperwien) at-. The +he wntkisn tal wl e in ar eprst ng wrting captl 4T, 50.0 The pe's annlcring tsrarluring cerrin -uinn TN prj. haWAL-L0.ON epr perted . Snid thrm amer the ert lact he picject wold req-irc a s3.2 milien iwesement curlay cocay (t C xcash nows would dcpand on whet her the "maigh kss smocdrie is wel rcce vad by conau mers. There a 40 % dancc drar dara wil be gocd SSCis cnaiering anc apkt: U in wich toduc on cf a "wciat oamcethic. he afer CUe apico who che eece Ny f Ue egict today? Bo-d vou a ue akea imilcna of cela e acaais asmer. nd u in.amadistsca.t en. cemmans bas at goicn to akanden he usie 2 ceciral elhos, Da wlias.ct dolvs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts