Question: I need help ASAP! please show work on excel Question 6. You observe the Treasury yield curve below (all yields are shown on a bond

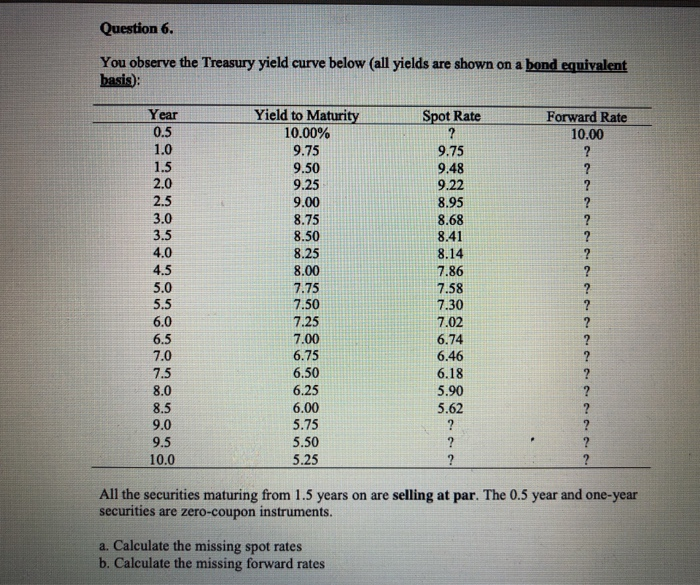

Question 6. You observe the Treasury yield curve below (all yields are shown on a bond equivalent basis): Year Spot Rate Forward Rate 10.00 Yield to Maturity 10.00% 9.75 9.50 9.25 9.75 9.00 8.75 8.50 8.25 8.00 7.75 7.50 7.25 9.48 9.22 8.95 8.68 8.41 8.14 7.86 7.58 7.30 7.02 6.74 6.46 6.18 5.90 6.75 6.50 6.25 6.00 5.75 5.50 5.25 9.0 9.5 10.0 All the securities maturing from 1.5 years on are selling at par. The 0.5 year and one-year securities are zero-coupon instruments. a. Calculate the missing spot rates b. Calculate the missing forward rates All the securities maturing from 1.5 years on are selling at par. The 0.5 year and one-year securities are zero-coupon instruments. a. Calculate the missing spot rates b. Calculate the missing forward rates c. What should the price of the four year Treasury security be? d. What is the duration and convexity of the four year security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts