Question: need help ASAP! Please show work on excel Question 5. You observe the Treasury yield curve below (all yields are shown on a bond equivalent

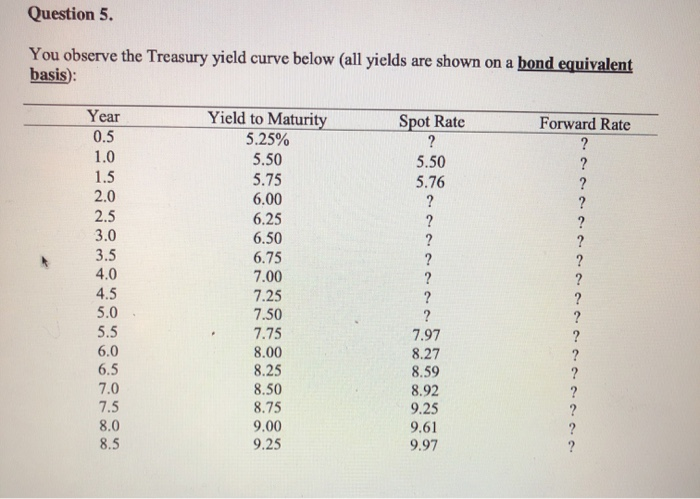

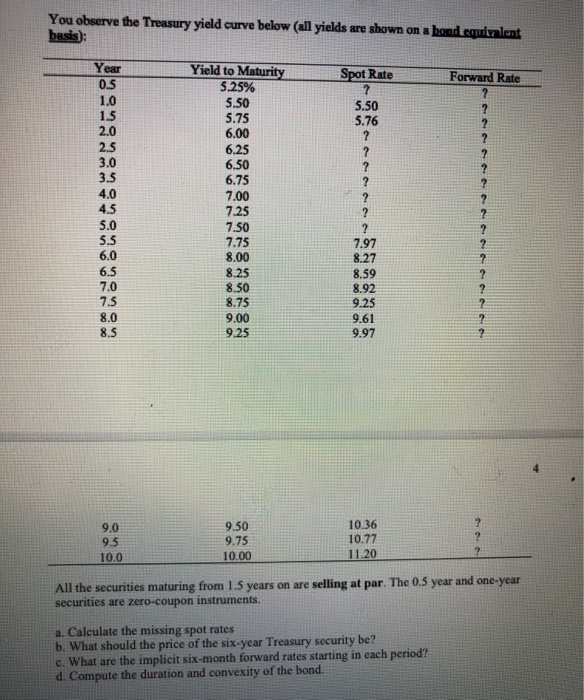

Question 5. You observe the Treasury yield curve below (all yields are shown on a bond equivalent basis): Spot Rate Forward Rate Year 0.5 1.0 5.50 1.5 5.76 2.0 2.5 3.0 3.5 4.0 Yield to Maturity 5.25% 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 7.75 8.00 8.25 8.50 8.75 9.00 9.25 5.0 6.0 6.5 7.0 7.97 8.27 8.59 8.92 9.25 9.61 9.97 You observe the Treasury yield curve below (all yields are shown on a bond equivalent basis): 5.50 ee Yield to Maturity 5.25% 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 7.75 8.00 8.25 8.50 8.75 9.00 9.25 ..... ee. .. ... 9.61 10.36 9.0 9.5 9.50 9.75 10.00 10.77 11.20 10.0 All the securities maturing from 1.5 years on are selling at par. The 0.5 year and one-year securities are zero-coupon instruments. a. Calculate the missing spot rates b. What should the price of the six-year Treasury security be? c. What are the implicit six-month forward rates starting in each period? d. Compute the duration and convexity of the bond. Question 5. You observe the Treasury yield curve below (all yields are shown on a bond equivalent basis): Spot Rate Forward Rate Year 0.5 1.0 5.50 1.5 5.76 2.0 2.5 3.0 3.5 4.0 Yield to Maturity 5.25% 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 7.75 8.00 8.25 8.50 8.75 9.00 9.25 5.0 6.0 6.5 7.0 7.97 8.27 8.59 8.92 9.25 9.61 9.97 You observe the Treasury yield curve below (all yields are shown on a bond equivalent basis): 5.50 ee Yield to Maturity 5.25% 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 7.75 8.00 8.25 8.50 8.75 9.00 9.25 ..... ee. .. ... 9.61 10.36 9.0 9.5 9.50 9.75 10.00 10.77 11.20 10.0 All the securities maturing from 1.5 years on are selling at par. The 0.5 year and one-year securities are zero-coupon instruments. a. Calculate the missing spot rates b. What should the price of the six-year Treasury security be? c. What are the implicit six-month forward rates starting in each period? d. Compute the duration and convexity of the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts