Question: I need help completing Statement AQBI Pass-through Entity Reporting (Schedule K-1, Box 20, Code Z) for ROCK the Ages LLC. *I SPECIFICALLY NEED HELP WITH

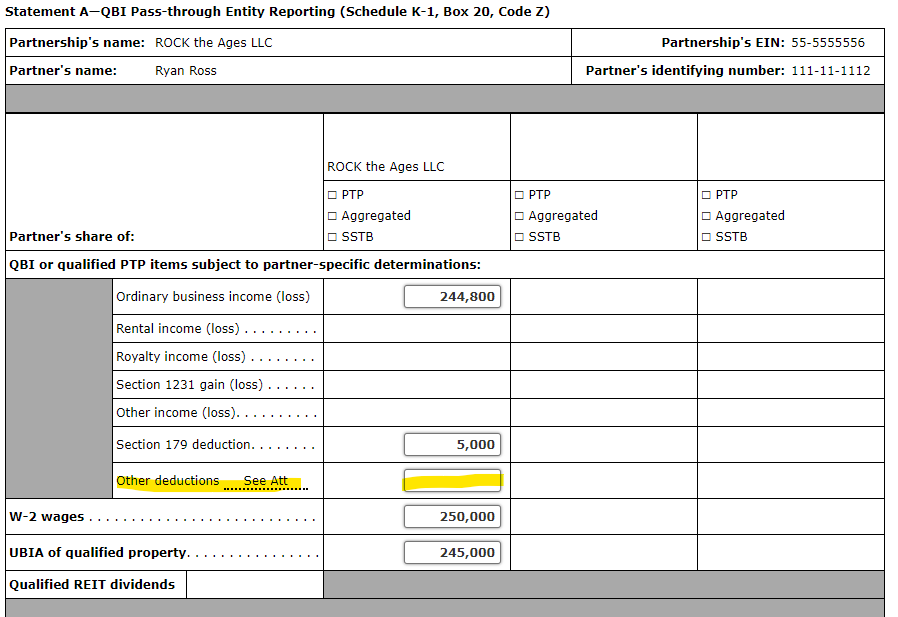

I need help completing Statement AQBI Pass-through Entity Reporting (Schedule K-1, Box 20, Code Z) for ROCK the Ages LLC.

*I SPECIFICALLY NEED HELP WITH THE "OTHER DEDUCTIONS" SECTION HIGHLIGHTED BELOW:

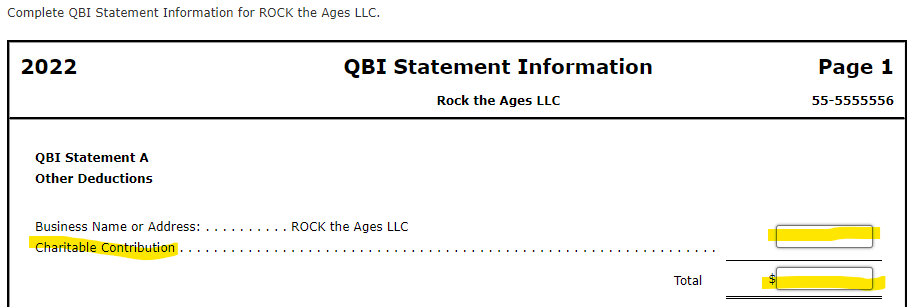

Statement A-QBI Pass-through Entity Reporting (Schedule K-1, Box 20, Code Z) Partnership's name: ROCK the Ages LLC Partnership's EIN: 55-5555556 Partner's name: Ryan Ross Partner's identifying number: 111-11-1112 ROCK the Ages LLC O PTP O PTP O PTP O Aggregated O Aggregated O Aggregated Partner's share of: O SSTB O SSTB O SSTB QBI or qualified PTP items subject to partner-specific determinations: Ordinary business income (loss) 244,800 Rental income (loss) . . . . . . . Royalty income (loss) . . . . . . Section 1231 gain (loss) . Other income (loss). Section 179 deduction. . . . . . . . 5,000 Other deductions See Att W-2 wages . . 250,000 UBIA of qualified property. . 245,000 Qualified REIT dividendsComplete QBI Statement Information for ROCK the Ages LLC. 2022 QBI Statement Information Page 1 Rock the Ages LLC 55-5555556 QBI Statement A Other Deductions Business Name or Address: .. ROCK the Ages LLC Charitable Contribution . . . . . .. Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts