Question: I need help completing these tax forms. For form 8829 I need to use 33% as my percentage of the personal home used for business.

I need help completing these tax forms.

For form 8829 I need to use 33% as my percentage of the personal home used for business.

AGI: $168,633

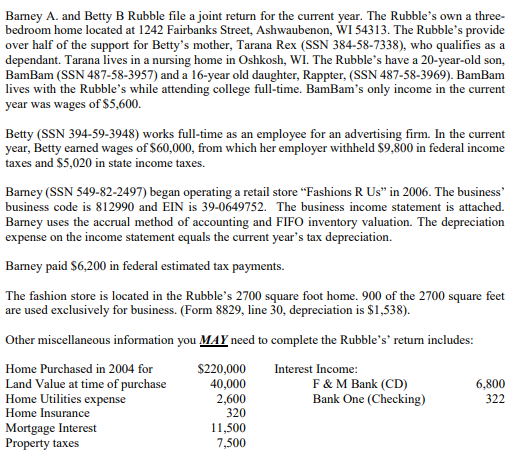

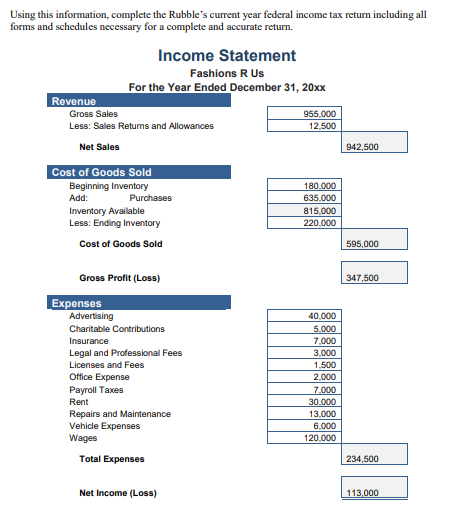

Bamey A. and Betty B Rubble file a joint return for the current year. The Rubble's own a three- bedroom home located at 1242 Fairbanks Street, Ashwaubenon, WI 54313. The Rubble's provide over half of the support for Betty's mother, Tarana Rex (SSN 384-58-7338), who qualifies as a dependant. Tarana lives in a nursing home in Oshkosh, WI. The Rubble's have a 20-year-old son, BamBam (SSN 487-58-3957) and a 16-year old daughter, Rappter, (SSN 487-58-3969). BamBam lives with the Rubble's while attending college full-time. BamBam's only income in the current year was wages of $5,600. Betty (SSN 394-59-3948) works full-time as an employee for an advertising firm. In the current year, Betty eamed wages of S60,000, from which her employer withheld $9,800 in federal income taxes and S5,020 in state income taxes. Barney (SSN 549-82-2497) began operating a retail store "Fashions R Us" in 2006. The business' business code is 812990 and EIN is 39-0649752. The business income statement is attached. Barney uses the accrual method of accounting and FIFO inventory valuation. The depreciation expense on the income statement equals the current year's tax depreciation. Bamey paid $6,200 in federal estimated tax payments. The fashion store is located in the Rubble's 2700 square foot home. 900 of the 2700 square feet are used exclusively for business. (Form 8829, line 30, depreciation is $1,538). Other miscellaneous information you MAY need to complete the Rubble's' retum includes: Interest Income: F&M Bank (CD) Bank One (Checking) 6,800 322 Home Purchased in 2004 for Land Value at time of purchase Home Utilities expense Home Insurance Mortgage Interest Property taxes $220,000 40,000 2,600 320 11,500 7,500 Using this information, complete the Rubble's current year federal income tax return including all forms and schedules necessary for a complete and accurate return. Income Statement Fashions R Us For the Year Ended December 31, 20xx Revenue Gross Sales 955.000 Less: Sales Returns and Allowances 12.500 Net Sales 942,500 Cost of Goods Sold Beginning Inventory Add: Purchases Inventory Available Less: Ending Inventory 180.000 635,000 815.000 220.000 Cost of Goods Sold 595,000 Gross Profit (Loss) 347,500 Expenses Advertising Charitable Contributions Insurance Legal and Professional Fees Licenses and Fees Office Expense Payroll Taxes Rent Repairs and Maintenance Vehicle Expenses Wages 40.000 5.000 7.000 3.000 1,500 2.000 7.000 30.000 13,000 6.000 120.000 Total Expenses 234.500 Net Income (Loss) 113.000 Bamey A. and Betty B Rubble file a joint return for the current year. The Rubble's own a three- bedroom home located at 1242 Fairbanks Street, Ashwaubenon, WI 54313. The Rubble's provide over half of the support for Betty's mother, Tarana Rex (SSN 384-58-7338), who qualifies as a dependant. Tarana lives in a nursing home in Oshkosh, WI. The Rubble's have a 20-year-old son, BamBam (SSN 487-58-3957) and a 16-year old daughter, Rappter, (SSN 487-58-3969). BamBam lives with the Rubble's while attending college full-time. BamBam's only income in the current year was wages of $5,600. Betty (SSN 394-59-3948) works full-time as an employee for an advertising firm. In the current year, Betty eamed wages of S60,000, from which her employer withheld $9,800 in federal income taxes and S5,020 in state income taxes. Barney (SSN 549-82-2497) began operating a retail store "Fashions R Us" in 2006. The business' business code is 812990 and EIN is 39-0649752. The business income statement is attached. Barney uses the accrual method of accounting and FIFO inventory valuation. The depreciation expense on the income statement equals the current year's tax depreciation. Bamey paid $6,200 in federal estimated tax payments. The fashion store is located in the Rubble's 2700 square foot home. 900 of the 2700 square feet are used exclusively for business. (Form 8829, line 30, depreciation is $1,538). Other miscellaneous information you MAY need to complete the Rubble's' retum includes: Interest Income: F&M Bank (CD) Bank One (Checking) 6,800 322 Home Purchased in 2004 for Land Value at time of purchase Home Utilities expense Home Insurance Mortgage Interest Property taxes $220,000 40,000 2,600 320 11,500 7,500 Using this information, complete the Rubble's current year federal income tax return including all forms and schedules necessary for a complete and accurate return. Income Statement Fashions R Us For the Year Ended December 31, 20xx Revenue Gross Sales 955.000 Less: Sales Returns and Allowances 12.500 Net Sales 942,500 Cost of Goods Sold Beginning Inventory Add: Purchases Inventory Available Less: Ending Inventory 180.000 635,000 815.000 220.000 Cost of Goods Sold 595,000 Gross Profit (Loss) 347,500 Expenses Advertising Charitable Contributions Insurance Legal and Professional Fees Licenses and Fees Office Expense Payroll Taxes Rent Repairs and Maintenance Vehicle Expenses Wages 40.000 5.000 7.000 3.000 1,500 2.000 7.000 30.000 13,000 6.000 120.000 Total Expenses 234.500 Net Income (Loss) 113.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts