Question: i need help D Question 9 1 pts The current spot exchange rate is $1.25 = 1.00. Consider a three-month American call option on e62,500

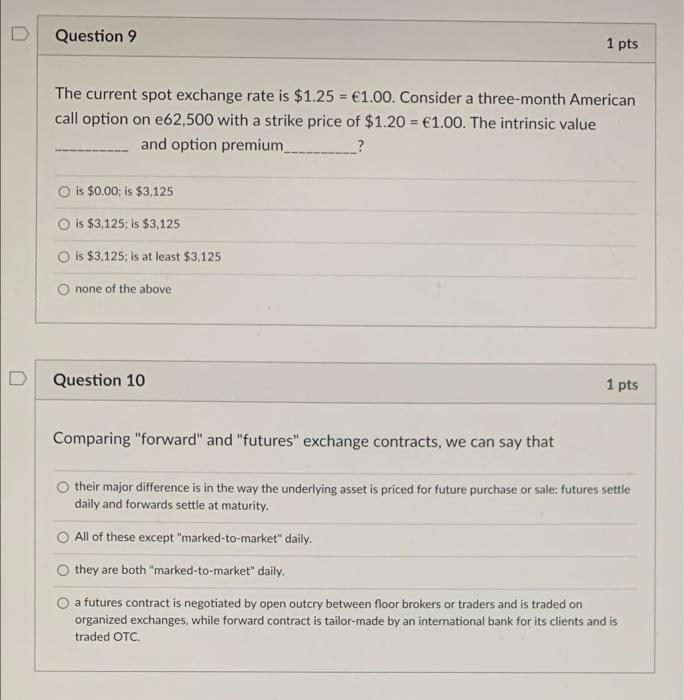

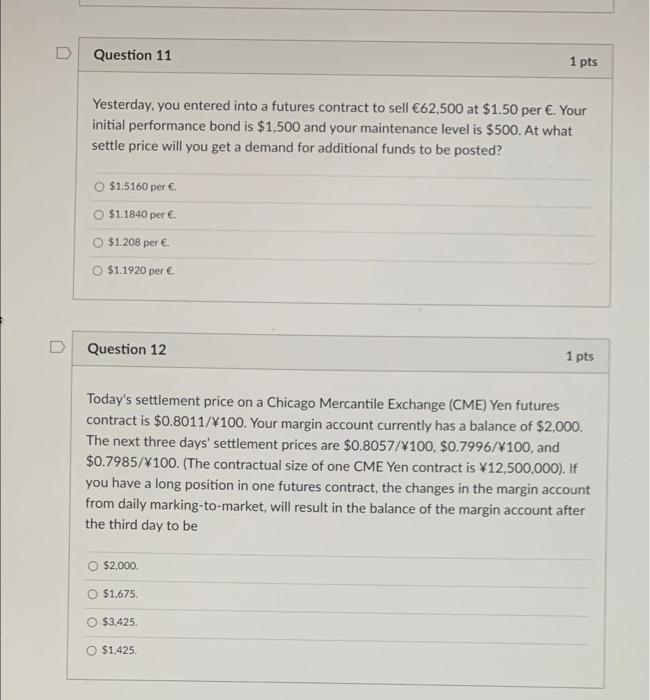

D Question 9 1 pts The current spot exchange rate is $1.25 = 1.00. Consider a three-month American call option on e62,500 with a strike price of $1.20 = 1.00. The intrinsic value and option premium is $0.00; is $3,125 is $3,125, is $3,125 O is $3,125; is at least $3,125 O none of the above Question 10 1 pts Comparing "forward" and "futures" exchange contracts, we can say that their major difference is in the way the underlying asset is priced for future purchase or sale: futures settle daily and forwards settle at maturity. All of these except "marked-to-market" daily. Othey are both "marked-to-market" daily. a futures contract is negotiated by open outcry between floor brokers or traders and is traded on organized exchanges, while forward contract is tailor-made by an international bank for its clients and is traded OTC. D Question 11 1 pts Yesterday, you entered into a futures contract to sell 62,500 at $1.50 per . Your initial performance bond is $1.500 and your maintenance level is $500. At what settle price will you get a demand for additional funds to be posted? $1.5160 per O $1.1840 per $1.208 per $1.1920 per Question 12 1 pts Today's settlement price on a Chicago Mercantile Exchange (CME) Yen futures contract is $0.8011/X100. Your margin account currently has a balance of $2,000. The next three days' settlement prices are $0.8057/X100. $0.7996/4100, and $0.7985/X100. (The contractual size of one CME Yen contract is 12,500,000). If you have a long position in one futures contract, the changes in the margin account from daily marking-to-market, will result in the balance of the margin account after the third day to be $2,000. O $1.675 $3,425 O $1,425

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts