Question: I need help explaining why this answers are correct, thx! If an organization's managers are risk averse, they will always prefer an investment opportunity with

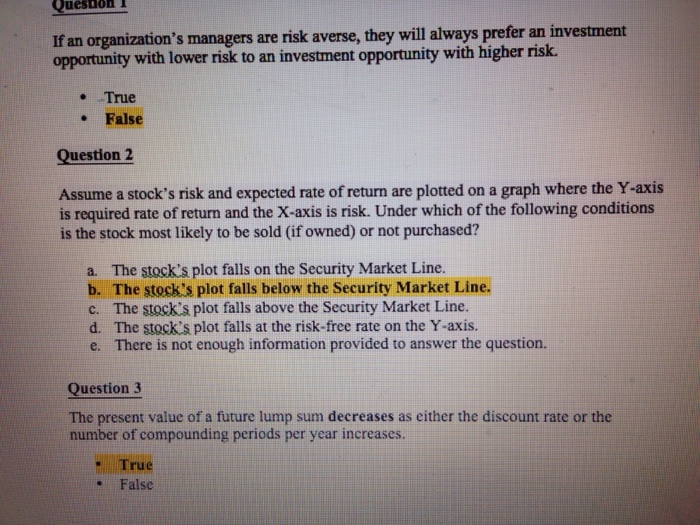

If an organization's managers are risk averse, they will always prefer an investment opportunity with lower risk to an investment opportunity with higher risk. Assume a stock's risk and expected rate of return are plotted on a graph where the Y-axis is required rate of return and the X-axis is risk. Under which of the following conditions is the stock most likely to be sold (if owned) or not purchased? The stock's plot falls on the Security Market Line. The stock's plot falls below the Security Market Line. The stock's Plot falls above the Security Market Line. The stock's plot falls at the risk-free rate on the Y-axis. There is not enough information provided to answer the question. The present value of a future lump sum decreases as either the discount rate or the number of compounding periods per year increases. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts