Question: PLEASE DO NOT USE EXCEL SOFTWARE TO SOLVE THIS QUESTION Jenny and Austin and their 3 children are currently living in a semi-detached house that

PLEASE DO NOT USE EXCEL SOFTWARE TO SOLVE THIS QUESTION

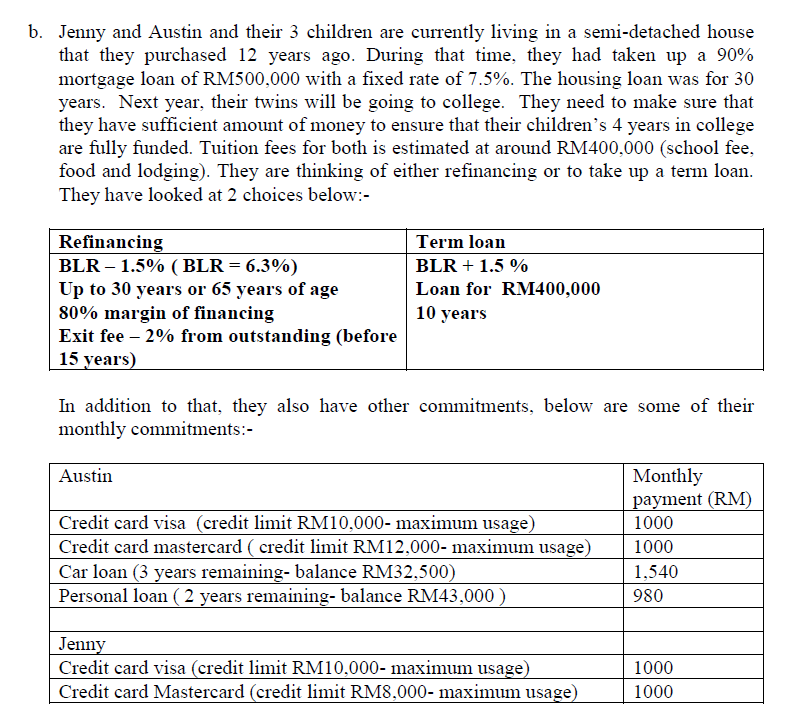

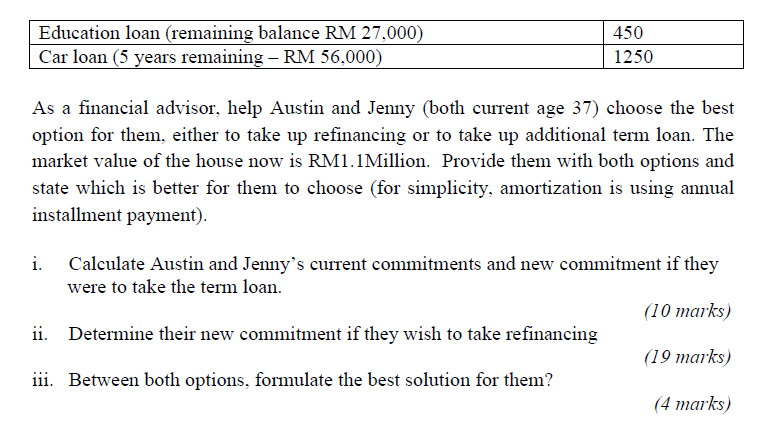

Jenny and Austin and their 3 children are currently living in a semi-detached house that they purchased 12 years ago. During that time, they had taken up a 90% mortgage loan of RM500,000 with a fixed rate of 7.5%. The housing loan was for 30 years. Next year, their twins will be going to college. They need to make sure that they have sufficient amount of money to ensure that their children's 4 years in college are fully funded. Tuition fees for both is estimated at around RM400,000 (school fee, food and lodging). They are thinking of either refinancing or to take up a term loan. They have looked at 2 choices below:- In addition to that, they also have other commitments, below are some of their monthly commitments:- As a financial advisor, help Austin and Jenny (both current age 37) choose the best option for them, either to take up refinancing or to take up additional term loan. The market value of the house now is RM1.1Million. Provide them with both options and state which is better for them to choose (for simplicity, amortization is using annual installment payment). i. Calculate Austin and Jenny's current commitments and new commitment if they were to take the term loan. (10 marks) ii. Determine their new commitment if they wish to take refinancing (19 marks) iii. Between both options, formulate the best solution for them? (4 marks) Jenny and Austin and their 3 children are currently living in a semi-detached house that they purchased 12 years ago. During that time, they had taken up a 90% mortgage loan of RM500,000 with a fixed rate of 7.5%. The housing loan was for 30 years. Next year, their twins will be going to college. They need to make sure that they have sufficient amount of money to ensure that their children's 4 years in college are fully funded. Tuition fees for both is estimated at around RM400,000 (school fee, food and lodging). They are thinking of either refinancing or to take up a term loan. They have looked at 2 choices below:- In addition to that, they also have other commitments, below are some of their monthly commitments:- As a financial advisor, help Austin and Jenny (both current age 37) choose the best option for them, either to take up refinancing or to take up additional term loan. The market value of the house now is RM1.1Million. Provide them with both options and state which is better for them to choose (for simplicity, amortization is using annual installment payment). i. Calculate Austin and Jenny's current commitments and new commitment if they were to take the term loan. (10 marks) ii. Determine their new commitment if they wish to take refinancing (19 marks) iii. Between both options, formulate the best solution for them? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts