Question: I need help figuring out the Accounts Payable Turnover, Long-Term Debt to Shareholders' Equity Ratio and Interest Coverage Ratio for the following company. Please include

I need help figuring out the Accounts Payable Turnover, Long-Term Debt to Shareholders' Equity Ratio and Interest Coverage Ratio for the following company. Please include the formulas so I can follow them to understand how to do this problem.

| CONSOLIDATED STATEMENT OF EARNINGS - USD ($) shares in Thousands, $ in Millions | |||

| 12 Months Ended | |||

| Jun. 30, 2022 | Jun. 30, 2021 | Jun. 30, 2020 | |

| Income Statement [Abstract] | |||

| Net sales | $ 7,107 | $ 7,341 | $ 6,721 |

| Cost of products sold | 4,562 | 4,142 | 3,658 |

| Gross profit | 2,545 | 3,199 | 3,063 |

| Selling and administrative expenses | 954 | 1,004 | 969 |

| Advertising costs | 709 | 790 | 675 |

| Research and development costs | 132 | 149 | 145 |

| Goodwill, trademark and other asset impairments | 0 | 329 | 0 |

| Interest expense | 106 | 99 | 99 |

| Other (income) expense, net | 37 | (72) | (10) |

| Earnings before income taxes | 607 | 900 | 1,185 |

| Income taxes | 136 | 181 | 246 |

| Net earnings | 471 | 719 | 939 |

| Less: Net earnings attributable to noncontrolling interests | 9 | 9 | 0 |

| Net earnings attributable to Clorox | $ 462 | $ 710 | $ 939 |

| Net earnings per share attributable to Clorox | |||

| Basic net earnings per share (in dollars per share) | $ 3.75 | $ 5.66 | $ 7.46 |

| Diluted net earnings per share (in dollars per share) | $ 3.73 | $ 5.58 | $ 7.36 |

| Weighted average shares outstanding (in thousands) | |||

| Basic (in shares) | 123,113 | 125,570 | 125,828 |

| Diluted (in shares) | 123,906 | 127,299 | 127,671 |

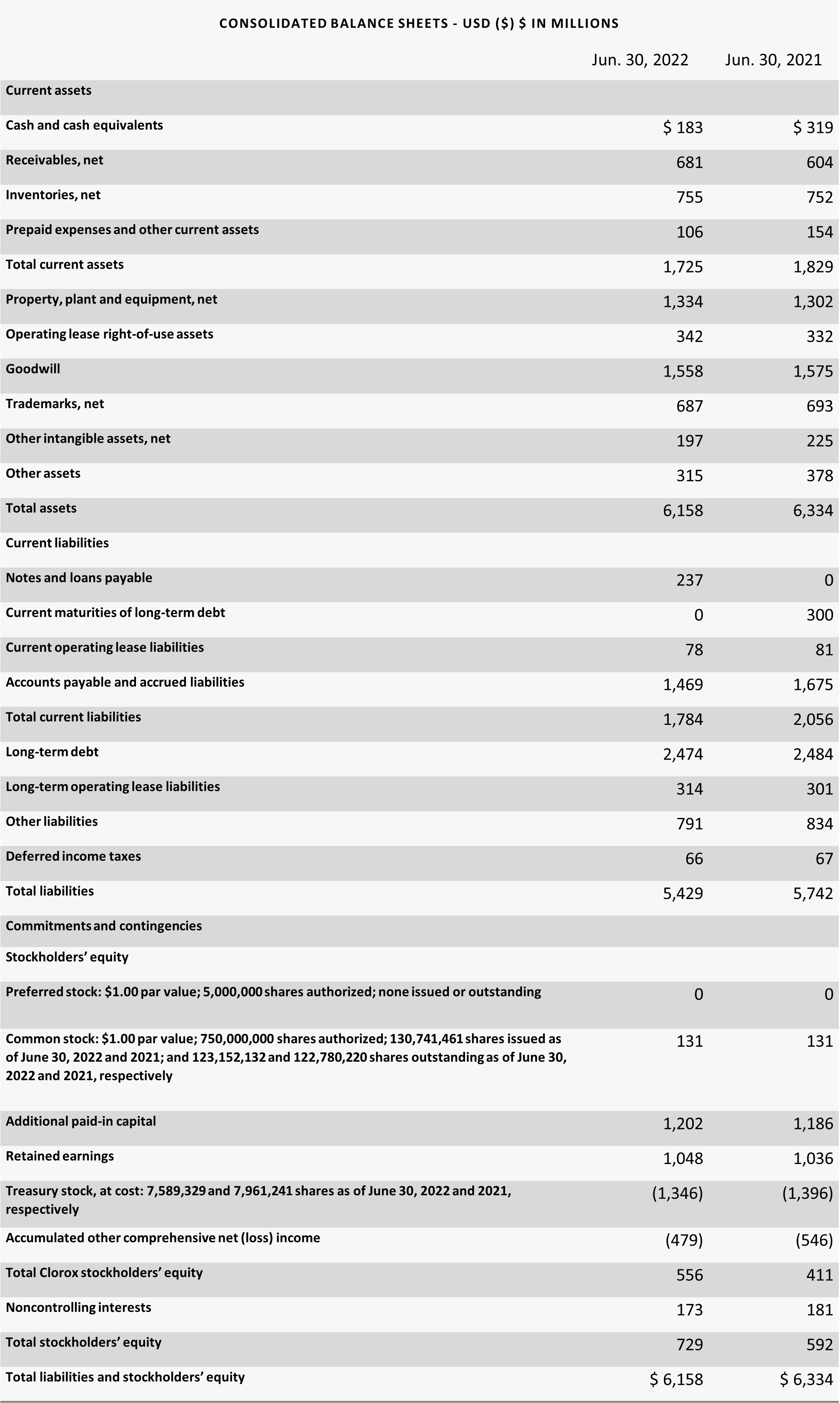

CONSOLIDATED BALANCE SHEETS - USD (\$) \$ IN MILLIONS Jun. 30, 2022 Jun. 30, 2021 Commitments and contingencies Stockholders' equity Preferred stock: $1.00 par value; 5,000,000 shares authorized; none issued or outstanding Common stock: $1.00 par value; 750,000,000 shares authorized; 130,741,461 shares issued as of June 30, 2022 and 2021; and 123,152,132 and 122,780,220 shares outstanding as of June 30, 2022 and 2021 , respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts